Farm Interest Expense Expected to Moderately Rise

Of all farm expenses, interest on debt is far from the top of the list. Many producers carry little or no financial leverage, reducing the average farm sector interest expense to just over 5% of total production expenses. But, as any student of agricultural finance knows, excessive leverage and interest rate risk can weigh down the farm economy to the brink of disaster. The 1980s farm financial crisis may be 40 years in the rearview, but its memory still echoes across the rural landscape. As the Federal Reserve considers the future of U.S. monetary policy and the cost of agricultural production continues to rise, sector interest rate risk is once again becoming a talking point among analysts and economists.

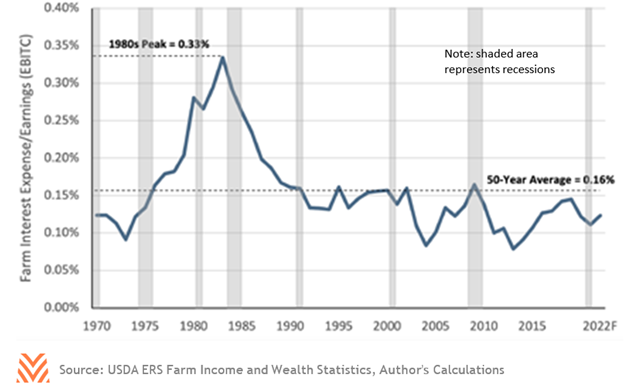

Fortunately, the U.S. ag sector is entering 2022 with a strong financial footing. According to the USDA’s farm income and wealth data series, farmers are expected to pay just under $23 billion in interest expense in 2022 on $467 billion in total farm debt. In total, the USDA forecasts the farm sector to take home $186 billion in earnings before interest, taxes, and capital expenditures (EBITC). Thus, sector interest expense represents only 12% of total earnings, a very manageable level and below the 50-year average of 16% (see the figure below). Current levels pale in comparison to the 1980s peak of 33%, when variable interest rate loans dominated balance sheets, interest rates skyrocketed in response to the 1970s stagflation, and farm income plummeted following the collapse of grain prices in 1980. While operations with debt routinely operate between 0.35 and 0.45 interest to EBITC, a value of 0.20 for the overall sector is a healthy threshold. If the sector interest to EBITC ratio stays below 0.20, a repeat of the 1980s farm financial crisis is unlikely.

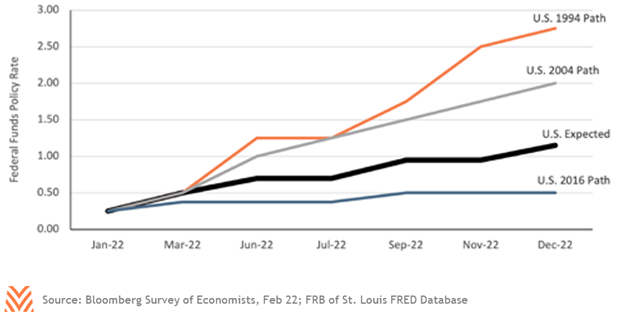

The logical next question is, “What could push the ratio up above that threshold?” Stress-testing the three components of the ratio (earnings, interest rates, and debt levels), it is exceedingly difficult to breach the threshold with any single variable. For example, leaving earnings and debt levels alone, it would take a 300 basis point increase in farmer- paid interest rates to shift the interest expense high enough to create systemic financial strain. As the figure below demonstrates, even with an aggressive rate policy correction, the U.S. Federal Reserve is unlikely to raise short-term rates by more than 250 basis points. Paths charted by the U.S. Fed in 1994 and 2004 showed 300 basis points of tightening, but the increases were spread over multiple years, giving borrowers time to lock in interest rates and mitigate future increases. Additionally, more farm debt is secured by real estate today than in the 1970s, when many operators used variable- and adjustable-rate products on real estate loans to manage and mitigate interest rate risk. Similarly, farm net cash income would need to fall by 38% to put the sector at risk. Even with higher production expenses, we are unlikely to see this level of earnings degradation. Only in 2002 was farm earning power at that level; not even during the 1980s did farm earnings hit the level that would be required to push the interest to EBITC ratio to 0.20 today. Finally, debt levels would have to rise by a massive 62% to push interest expenses at these rates. Even assuming a 125 basis point increase in average farm rates, debt levels would have to rise by 30% to push into caution levels.

It may be difficult to shock any single component of interest-to-EBITC enough to create strain, but if all components move against the sector, the ratio can rise quickly. For example, a 10% decline in net cash income combined with a 125 basis point increase in rates and a 15% increase in debt loans would be enough to push the sector to 0.20. While that scenario is a very bleak and unlikely one for producers, it’s not out of the realm of possibility. Operators and lenders must continue to be vigilant with interest rate risk management, and locking in today’s low interest rates to protect against future increases might be a good strategy to protect lenders’ and borrowers’ balance sheets.