Fall Rains Ease Midwest Drought and Replenish Mississippi River

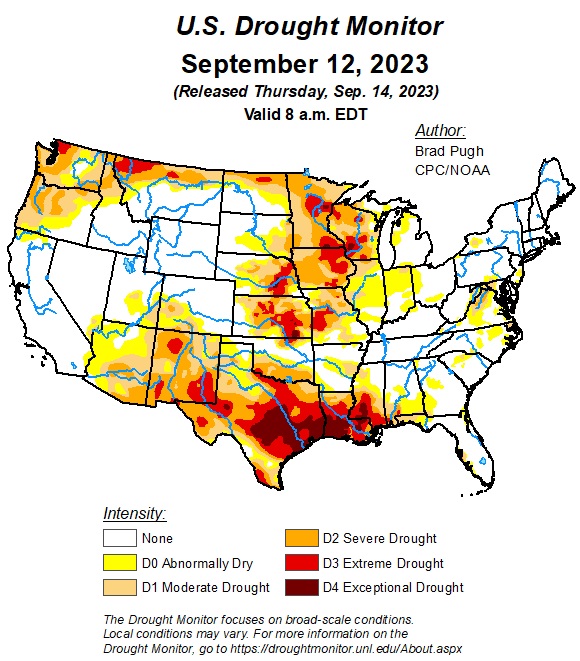

For most U.S. agricultural producers, weather represents a perennial wildcard. Excess precipitation at inopportune times can delay planting or harvesting, or worse yet, washout crops. Meanwhile, too little rain can inhibit plant growth and reduce yields, sometimes dramatically. For many growers across the upper Midwest, the 2023 growing season was closer to the latter. Drought conditions developed across a swath of this summer and continued into fall. Over 60% of Minnesota was classified as in severe drought status or worse as of September 12. Likewise, drought conditions were severe or worse for 73% and 59% of Iowa and Wisconsin, respectively. Despite the drought conditions that prevailed over the summer, the USDA projects a relatively limited impact on average crop yields. However, regardless of the impact on yields, water levels on a critical transportation route for these crops have been significantly affected.

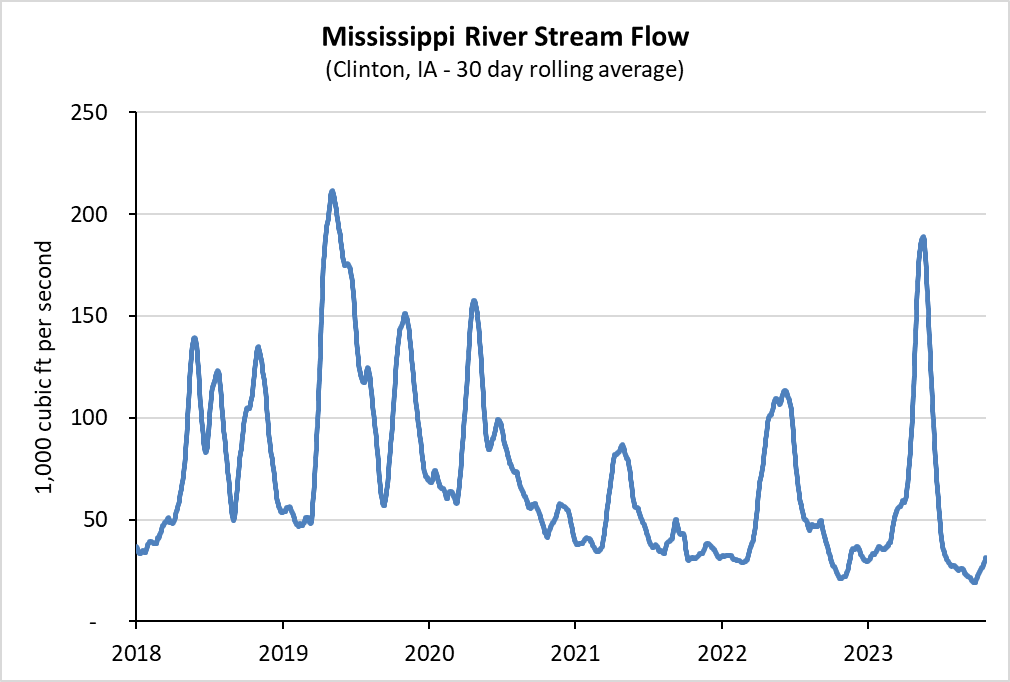

A lack of summer precipitation across many states in the upper Midwest had a cascading effect on Mississippi River levels downstream. For the second consecutive year, below-average summer precipitation caused fall water levels on the Mississippi to drop sharply. The average water flow on the Mississippi River in Eastern Iowa declined to the lowest level in September since 2012. The Mississippi River is a crucial artery for transporting grain produced in the interior U.S. to export markets. Lower water levels create a bottleneck for barge traffic, reducing the quantity of barges that can travel downstream and the amount they can transport. As a result, the cost to ship grain via barge was 95% higher in September than the long-term historical average for the month. Higher transportation costs ultimately impacted the cash price for grain upstream.

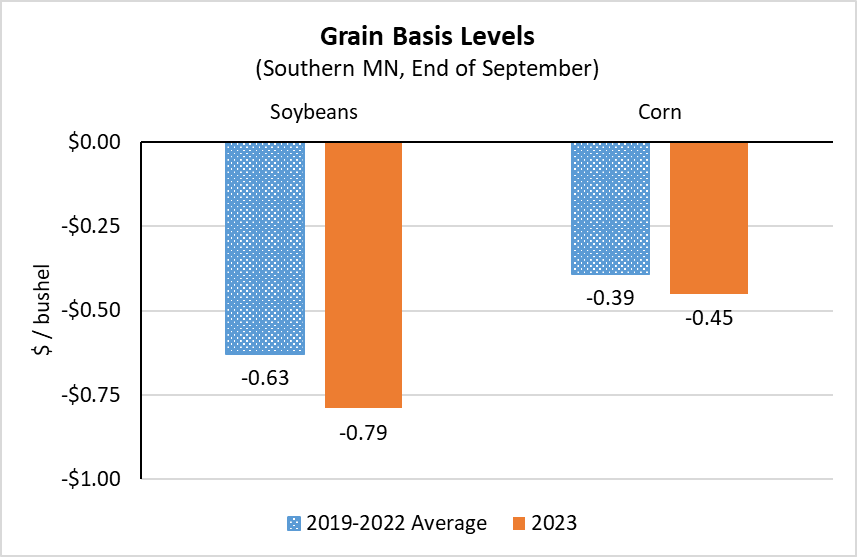

Higher transportation costs led to a drop in grain basis levels across many upper Midwest states in September. “Basis” is the difference between the local cash price and the futures price. It reflects both the cost of transporting grain and a myriad of other factors, including regional supply and demand. It is not uncommon for basis patterns to fluctuate year to year, but the decline in September was notable in many states in the upper Midwest. For example, Minnesota basis prices were 15% and 26% lower in September for corn and beans, respectively, relative to the four previous years.

The decline in basis has been notable, but the impact on farm revenues has relatively minor thus far. For example, the USDA reported 2022 average yields of 199 and 61 bushels per acre for corn and soybeans, respectively, in Filmore County in . This would constitute a relatively small proportion of total revenue per acre. On top of this, many farmers likely did not sell their full crop in September when basis diverged the furthest from the historical average. There are additional mitigating factors as well.

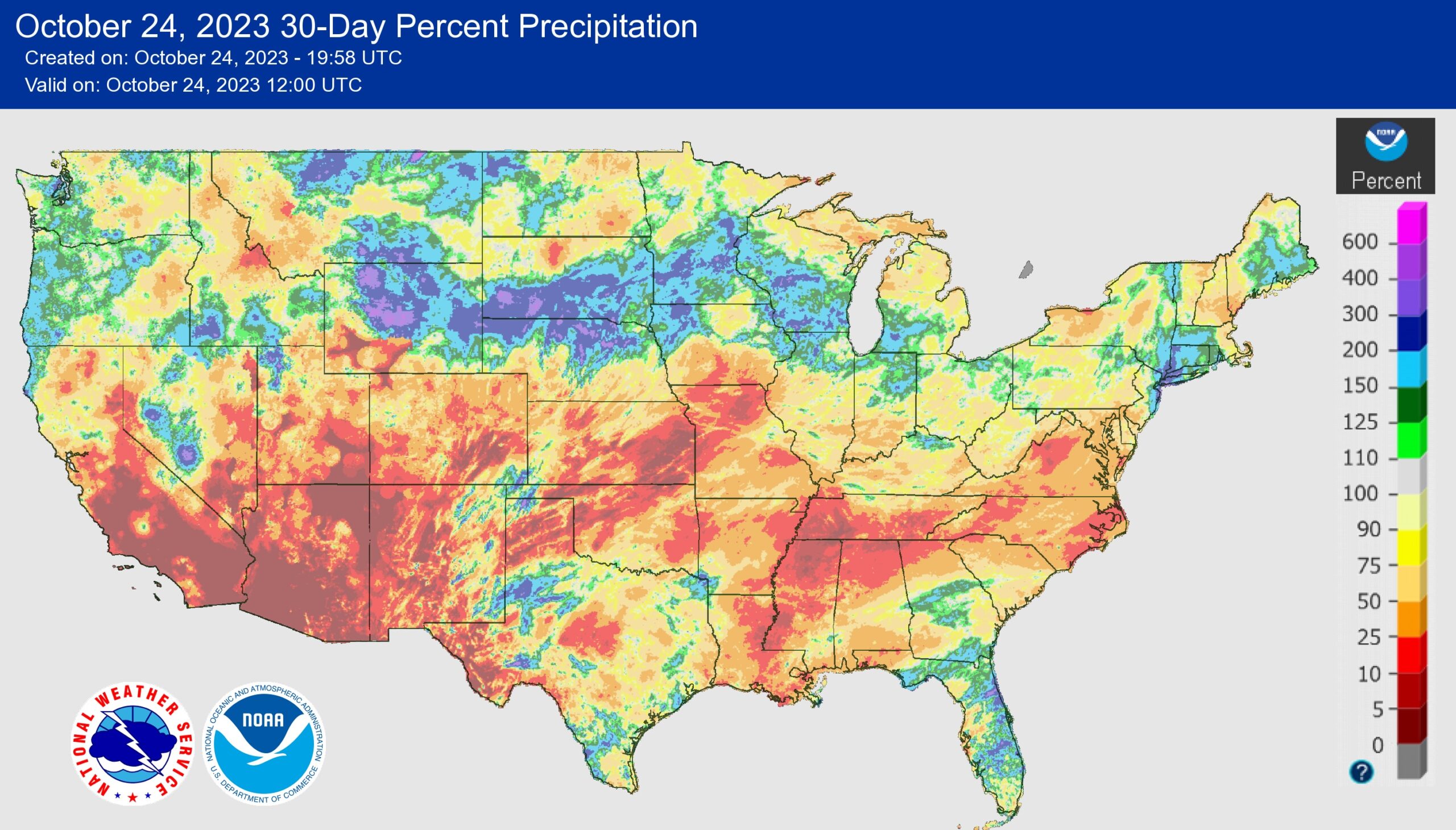

Crucially, fall finally brought a reprieve from dry summer conditions with above-average rainfall across a wide swath of the upper Midwest, causing the Mississippi River to rise in late and into October. Portions of Minnesota received over 300% of the normal rainfall from September 25 to October 24. This rainfall and subsequent higher river levels relieved pressure on grain transportation, causing barge freight rates to drop 41% from their 2023 peak.

Beyond the recent rainfall, not all farmers in the Upper Mississippi River basin were impacted by the low water levels in September. Some producers simply shifted grain sales to elevators that utilize rail to ship grain. Rail shipping costs were 10% lower in September relative to last year, providing support for basis. Meanwhile, many other producers have expanded grain storage capacity in recent years and simply chose to store their grain until later when basis prices recovered. Ultimately, the dip in basis levels could contribute to margin compression for farm incomes in 2023, but the impact may be relatively small compared to other factors.