Disruption in Black Sea Production Could Influence U.S. Grain Producers

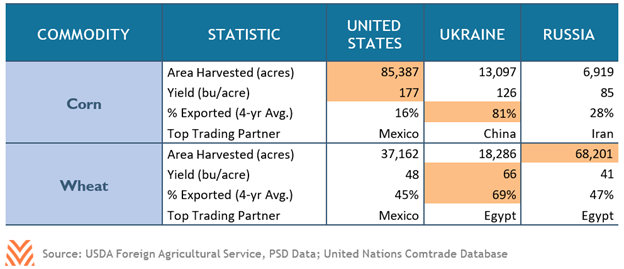

Often called the “Breadbasket of Europe,” the fertile soils to the northeast of the Black Sea, spanning much of Ukraine and into Russia, make for incredibly productive farmland. According to data from the United Nations and The World Bank, Ukraine boasts over 100 million acres of production agriculture, and agriculture generates over 9% of the country’s gross domestic product each year. The Russian Federation is also an active participant in global food production, with more than 532 million acres of agricultural land, over 300 million of which is arable. As the figure below shows, the U.S. has a large comparative advantage for corn production, but Ukraine’s production has been making strides in export markets. The Black Sea region is highly productive for wheat, with Russian wheat production nearly 70% higher than U.S. production. Ukrainian producers maintain astonishingly high yields, producing only 25% less than the U.S., but on 50% less land.

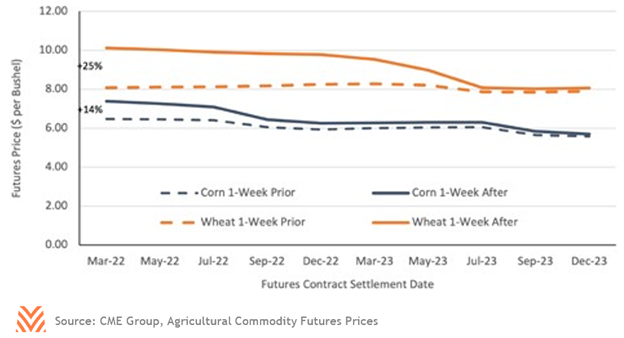

In March, global markets were trying to assess the Russian- Ukrainian conflict’s damage to global grain supplies. Because of Ukraine’s efficiency in wheat production and Russia’s high volume of wheat exports, wheat futures prices jumped by 25% after Russia invaded Ukraine. This increase was notable across futures contracts into early 2023, likely a function of traders’ interpretations of the immediate impacts of damage to the winter wheat crop in Ukraine but also the potential for a longer sanction period from western economies against Russia. Corn prices also substantially increased, as China is a major buyer of Ukrainian corn. U.S. producers sell a high percentage of corn and wheat exports to neighboring Mexico, whereas the Black Sea regional trading partners are China, Egypt, and Iran. The U.S. may witness some redrawing of trade lines in 2022 if global commodity flows are disrupted. This disruption is also highly likely to exacerbate rising global food prices, pushing against in-flight economic recoveries and increasing inflationary pressures.

U.S. producers are faced with some interesting choices this spring with all this information. Relative grain commodity prices may heavily influence planting decisions in 2022, with acres potentially oscillating between spring wheat, corn, and soybeans. Complicating this decision are the availability, cost, and application needs for fertilizers and soil nutrients by the different commodities. International sanctions against Russia in February and March drove up energy prices, agitating an already-tight fertilizer market. Lenders may see additional operating line activity as these prices remain high and coops struggle to meet input demand in March and April.