Dairy Prices Firm in 2022 but Are Waning With Global Demand

Dairy production and supply have been ample in 2022. While the U.S. experienced a drop in the number of milking cows early in 2022, herd size picked up in the second half and was up approximately 1% in September compared to 2021. The rebound in milking cow herd size combined with improved efficiency per cow has put total year-to-date U.S. milk production at an all-time high through October 2022. Meanwhile, U.S. stocks of American cheese in cold storage hit an all-time high in July, at 860 million pounds. Butter supply has moderated somewhat since hitting peaks in 2021, but also remains elevated compared to recent history.

High supply has been well balanced with robust dairy product demand in 2022. Domestic use of cheese and butter supported milk processing throughout the year. Exports started the year off strong, particularly for nonfat dry milk products (up 26% from 2021), fresh cheeses (up 22% from 2021), and whey protein (up 62% from 2021). The USDA expects export demand to hold up in the fourth quarter of 2022, capping off what could be the strongest year in history for U.S. dairy exports. Global demand was aided by the economic recovery from COVID-19 lockdowns in 2020 and should help boost export sales in early 2023, despite some headwinds to regional economies around the world.

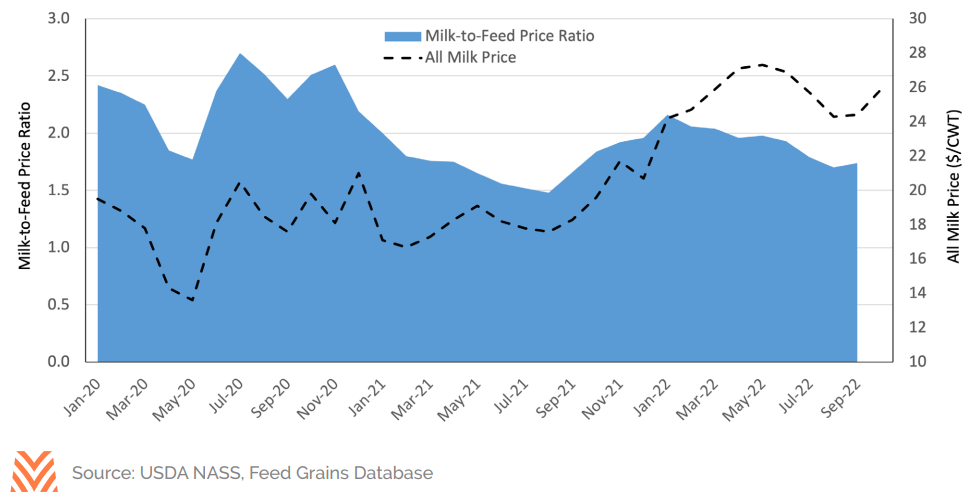

Strong demand outpaced strong supplies in U.S. dairy products, helping boost prices throughout the year. As the figure below highlights, the all-milk price, blended across classes, paid to dairy producers in 2022 has averaged approximately 33% higher than in 2021. Component prices for cheese, butter, and nonfat dry milk are the primary reason for the advance in milk prices. However, a pullback in nonfat dry milk prices in the third quarter of 2022 caused a milk price decline, and thus the USDA’s expected all-milk price average in 2023 is $22.60 per hundredweight, a 10% decline from 2022 levels. The biggest threats facing dairy producers are increasing production costs and declining demand from China. The monthly average price paid for high-quality alfalfa hit an all-time high in October 2022, at $281 per ton. Eight of the top 10 most expensive months of prices paid since 1958 were in 2022, primarily due to a combination of high commodity prices and drought conditions. The milk-to-feed price ratio, a relative measure of the price of milk to the cost of feeding the cows that produce it, is hovering around the 3-year average and could fall to a low point if prices drop in 2023. “COVID Zero” policies in China continue to hurt economic activity in that country, and Chinese imports of nonfat dry milk slowed in the second half of 2022. Without a demand signal from China, there will be greater competition amongst exporting countries for nonfat dry milk products, which could, in turn, put downward pressure on U.S. milk prices. While 2022 was a good year for dairy producers, a few clouds remain on the horizon as the calendar flips to 2023.