Cream of the Crop: High Calf Prices Altering Dairy Economics

U.S. dairy production is poised to rebound in 2025, aided by a small increase in dairy cattle numbers. The growth in dairy cattle numbers bucks the contraction trend of the broader cattle markets, which saw total U.S. cattle numbers drop for the sixth consecutive year in January. The growth in dairy cattle numbers is also relatively surprising considering the trend in dairy heifer retention rates.

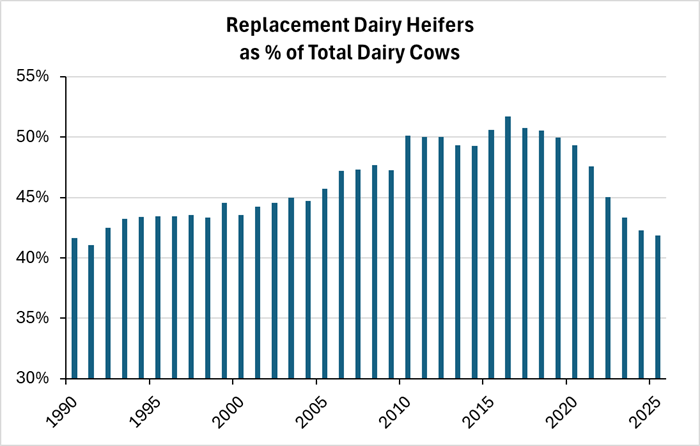

Replacement dairy heifers as a percentage of the total dairy herd trended up through time as dairy producers embraced genetic turnover via indexing or other methods. Indexing cattle allows producers to selectively breed replacement heifers from cows that score the highest on a list of desirable traits. In doing so, producers can keep older or inferior cows for a shorter number of years and replace them with heifers that possess superior genetics. To accomplish this, heifer numbers were relatively stable to increasing. Meanwhile, the total number of milk cows in the U.S. trended lower.

The pattern of rising heifers as a proportion of total dairy cows began to reverse about a decade ago. The proportion peaked at 52% in 2015 and has dropped every year since then. The driving factors have been two-fold. First, the rising prevalence of gendered artificial insemination (AI) breeding allowed producers to confirm the gender of baby calves with greater than 90% certainty. Historically, approximately 50% of dairy calves were female, and half were male. Gendered AI breeding, in theory, allows producers today to produce a calf crop of nearly 100% female cows. This allows a herd to rapidly replenish. But to understand why dairy herd managers do not simply breed only heifers, one simply needs to look at the second factor: high beef prices.

High Cattle Price Spillover

One of the primary drivers of the dairy heifer trend is related to the beef sector. The U.S. beef cattle herd has declined in number for six consecutive years. Fewer cattle amid strong beef demand, both domestic and from abroad, has led to a surge in prices. Live cattle prices continue to set new records for the third consecutive year in 2025. Furthermore, there remains little evidence that the overall U.S. cattle herd is poised to begin growing again.

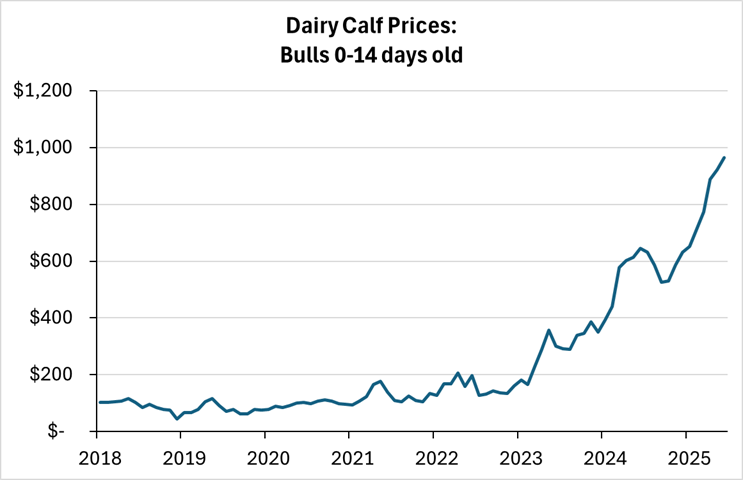

The impact of record-high beef prices has spilled over into the market for U.S. dairy calves. Historically, the market for U.S. dairy calves was sleepy. Holstein, Jersey, and other dairy cattle breeds produce beef that grades out inferior to other beef cattle breeds. Lower prices for the end product historically meant limited demand and lower prices for the calves at the beginning. Demand has been anything but limited, though, for U.S. dairy calves in recent years. The USDA composite national average price for bull dairy calves approached $1,000 per calf this summer. This is the highest level on record and over 10 times higher than price levels as recent as 2021.

So, What’s the Catch?

The underlying driver of the exponential growth in prices for dairy steers? Dairy steers today are no longer the purebred dairy offspring of yesteryear. The advent of gender-specific AI has allowed dairy producers to retain enough heifers to backfill their operation with only a much smaller proportion of their herd’s calves. This has freed up the remaining dairy cattle that do not receive dairy gender specific AI breeding. Instead, these lower-quality or older dairy cows have increasingly been crossbred with beef cattle.

The practice, termed “beef on dairy,” has been used for decades, including historically, to reduce the cost of breeding dairy cattle. Beef on dairy has picked up steam over the past decade as gendered AI first took off, and then cattle prices surged. This led to a delayed but strong surge in demand for crossbred beef on dairy calves. Beef on dairy calves still generally produce a beef product that is considered inferior to other traditional beef cattle varieties. However, the beef from crossbred dairy cattle represents a significant improvement in quality, and feedlots are making it worthwhile for dairy producers to breed them.

At this rate, it is understandable why dairy producers are so enticed by high calf prices. Data from the University of Wisconsin shows calf sales constituted approximately 2% of dairy revenues in 2019. Extrapolating the growth in calf prices to dairy farms today, calf sales may constitute more than 10% of dairy farm revenues. This increase represents a meaningful jump, especially during a period of rising costs for many inputs.

Elusive Dairy Expansion

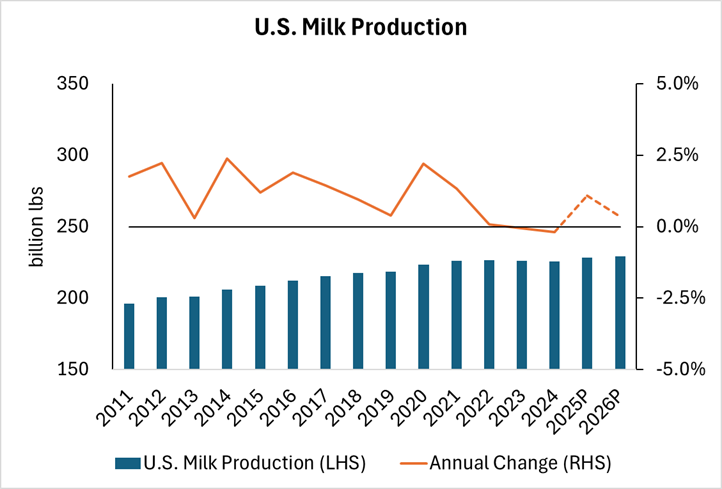

Dairy producers capitalizing on high calf prices has been a contributing factor to the slow expansion of U.S. milk production. In 2024, total U.S. dairy production declined for the first time in 15 years after flat growth in both 2022 and 2023. The restraint in dairy expansion was not solely a function of poor profitability in the sector. Indeed, dairy profitability was relatively strong in both 2022 and 2024. In fact, the last time dairy profitability reached a comparable level was 2014. At that time, producers responded by increasing production 5.6% from the end of 2013 through 2016, contributing to a sharp drop in prices and profit margins. An expansion in the dairy industry has proved elusive in this cycle. U.S. milk production is only projected to grow 1.4% from the end of 2023 through 2026, less than one-third of the 2014 increase.

There are numerous headwinds to dairy expansion, many of which have persisted for years. Rising interest rates have severely complicated the economics of paying for an expansion. In a similar vein, building material costs remain significantly higher today than five years ago, even if costs have subsided for many products. Uncertainty surrounding trade is a key determining factor as well. The U.S. dairy industry is not as reliant on exports as other agricultural commodities, such as soybeans or almonds. However, exports represent an important source of demand growth, constituting nearly 20% of U.S. dairy production in 2024.

Outlook for Dairy

Like many other agricultural sectors, the dairy sector’s outlook may hinge largely on trade. Sustaining prices at current levels would likely require robust export volumes throughout 2025. A weaker USD has certainly helped support export volumes so far this year. However, an indirect impact on dairy could also come from trade developments in the beef sector. Live cattle prices could stay elevated for the foreseeable future if supplies remain tight amid a continued herd contraction. Conversely, global demand for U.S. beef could decline if trade negotiations with key export markets are not successful. Until the economics shift in favor of a dairy expansion, producers are likely to continue to try to maximize near-term profitability. Dairy calves may just be a significant part of that story for now.