Corn and Soybean Update

Corn and soybeans have had a turbulent year. One month into the pandemic, national average cash prices for corn settled as low as sub-$3.00 per bushel. By October, national December corn futures prices were as high as $3.80 per bushel, near pre-pandemic levels. Soybeans also fell—though never as far as corn did—and rebounded, spending the last weeks of summer with cash prices at their highest point since early 2018. The story of how these two commodities bounced back involves a lot of underlying good news in a year dominated by the pandemic.

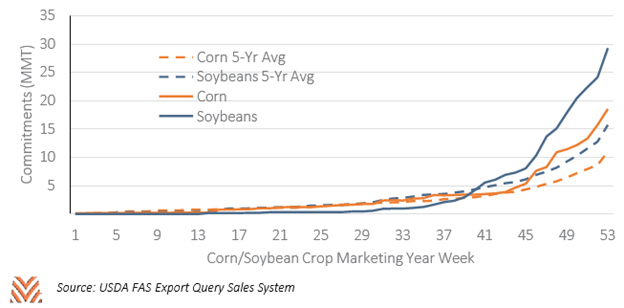

One reason for this stunning turnaround is a historic level of new crop commitments from our trading partners. As expected, Chinese commitments for the 2020-21 Crop Marketing Year (“CMY”) are very robust and represent more than half of all commitments. However, China very infrequently commits to the next CMY corn. At the height end of the commodity supercycle, China made unprecedented commitments exceeding 3 million metric tons (“MMT”), which reverted to zero commitments the following year. This year, China has committed to the purchase of more than 8 MMT of corn. China’s twin challenges of drought and the repopulation of its hog herds have led to the immense demand for foreign corn.

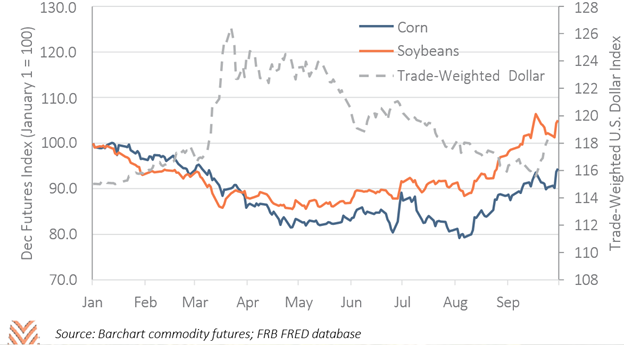

Both commodities are also benefitting from the pullback of the U.S. dollar. At the onset of the pandemic, a surging dollar put additional pressure on commodities beset by declines in foreign demand and decreased biofuels use. This issue was critical for corn and soybeans, as crucial currencies like the Brazilian real fell against the dollar more than 30% since January. In recent months, corn and soybeans have both received support from the specific relationship between major agricultural importer currencies and the U.S. dollar. Currencies like the Chinese Yuan, Japanese Yen and South Korean Won have strengthened relative to the U.S. dollar. This strength is part of the reason behind the very strong commitments seen heading into the new crop marketing year.

Both commodities have also seen unexpected support due to changes in USDA forecasts. The third quarter stocks report was bullish for both corn and soybeans, with all-position corn and soybeans stocks both lower than industry expectations by 10%. September 1 corn stocks were lower than four of the last five years despite marked decline in use for ethanol this year. This follows a year of bullish revisions for the commodities. Acreage reports lower production expectations for corn and soybeans, late- season challenges have lowered forecasts for yields and production, and crop conditions have come off their high points from the start of the growing season. Between the August and September USDA World Agricultural Supply and Demand Estimate release, forecasts for average farm price rose 40 cents per bushel for corn and 90 cents for soybeans. With the new stocks report, both forecasts have the potential to rise even further.

Corn benefitted from these revisions more than soybeans. The U.S. corn crop for the 2020-21 CMY, once forecast near 16 billion bushels, is now forecast at 14.9 billion. National crop conditions plummeted right before harvest and are only modestly better than the rain-drenched crop from 2019. Meanwhile, drought and high winds are lowering expectations across much of the upper Midwest, further driving up price. Corn is also performing well as an export, outperforming Brazilian corn due to tight supplies in Brazil and a weak dollar. While foreign production is expected to increase for harvests during the 2021 calendar year, increased animal production is forecast to partially offset these increases.

The story for soybeans is similar, though more dependent on changes in export expectations. National conditions have fallen in the weeks before harvest, leading to declining production forecasts. Given expectations for 2.1 billion bushels in exports, ending stocks to use ratios are just above 10%. These levels are above use ratios seen during the commodity supercycle but are generally favorable. There is also some limited evidence that Chinese hog repopulations from the African Swine Fever are ahead of schedule. After a year of record purchases from South America, Brazil is facing a shortage of soybeans, pushing China to purchase more U.S. goods.

The long-term trend for corn and soybeans is still a case for concern. Foreign production increases every year. Despite poor weather heading into harvest, this year’s corn crop will likely set another record. Protein demand often suffers during recessions, implying less demand for feed through the recovery. Continued investments in infrastructure in major competitors like Brazil will narrow the price gap between nations. However, the good news from 2020 is almost enough to make up for the direct challenges corn and soybeans have faced from the pandemic.