Cattle Prices Buoyed by Lower Herd Size

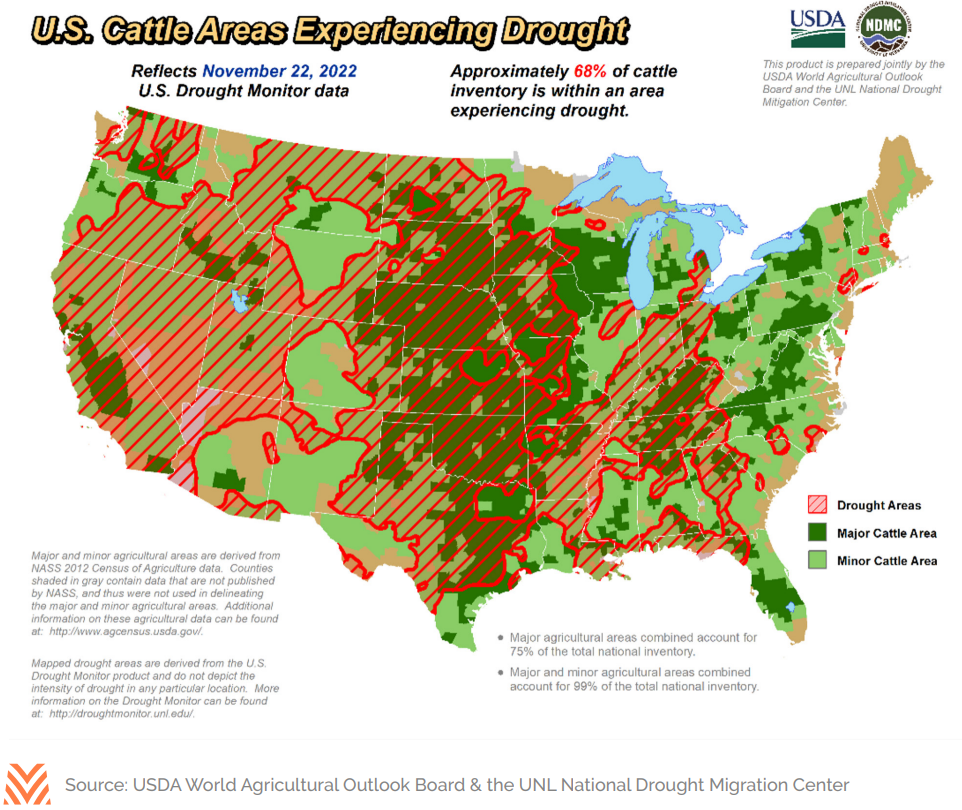

Cattle producers continued to consolidate herds in 2022, driving the beef cow inventory to its lowest levels since 2015. USDA daily cattle slaughter throughput in 2022 was 3.3% higher on average compared to 2021 and was 5.1% higher than its three-year pre-pandemic average. Drought conditions in 2021 forced many cattle producers to reduce or liquidate herds, and while conditions in mountain states improved in the past year, they worsened in the Plains and upper Midwest throughout 2022. In late November 2022, approximately 68% of cattle inventory was within an area experiencing at least modest drought conditions (see the figure below). That compares to just 10% of cattle inventory in drought conditions in November 2019.

Luckily for the cattle complex, demand for beef has held up in 2022. The USDA estimates that the per capita disappearance of beef hit a multi-year high in 2022, at 59.2 pounds per person. A combination of the strong economy and a recovery of business and personal travel helped push consumption throughout the year. Retail prices for beef spiked in 2022 as the meat case led all measures of food price inflation. Retail ground chuck prices were up 10% annually in August 2022, setting an all-time record high average price. Meanwhile, U.S. beef exports are on track to set an all-time high record in 2022, driven by a large increase in exports to China. China has quietly become a major market for U.S. beef, a huge release valve for the U.S. beef complex.

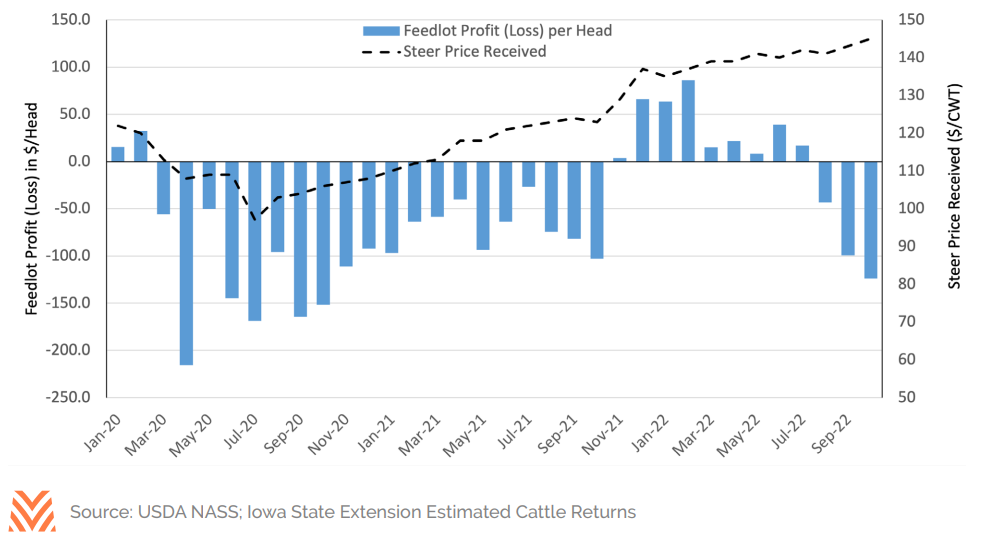

The combination of constrained supply and heated demand pushed prices for beef cattle steadily higher in 2022. The figure below shows the average price received by ranchers for cattle over 500 pounds between January 2020 and October 2022. From 2020 lows, cattle prices are up nearly 50%. The largest gains in cattle prices were experienced, when feedlot profitability levels flipped to positive in the early months of 2022, signaling improved demand for cattle through the beef supply chain. The USDA forecasts that these prices will hold in 2023, when the full effects of lower inventory start to restrict slaughter throughput.

The primary threats to cattle producers in 2023 will likely be consumer price fatigue and a slowing global economy. Consumers faced with two consecutive years of near-double-digit increases in beef prices have started to switch to lower- priced proteins like pork, poultry, and fish in 2022. Beef and veal was the only protein category to experience a consumer price decline in 2022 as a result. Similarly, higher beef prices are likely to challenge global consumers, particularly in a slowing economy. Some of the recent gains in beef exports could be given back if conditions worsen more than expected. Despite these potential headwinds, cattle ranchers are still likely to sell at higher prices in 2023 compared to the doldrums of 2020 and 2021.