Cattle Contraction Lifts Cow-Calf Profitability

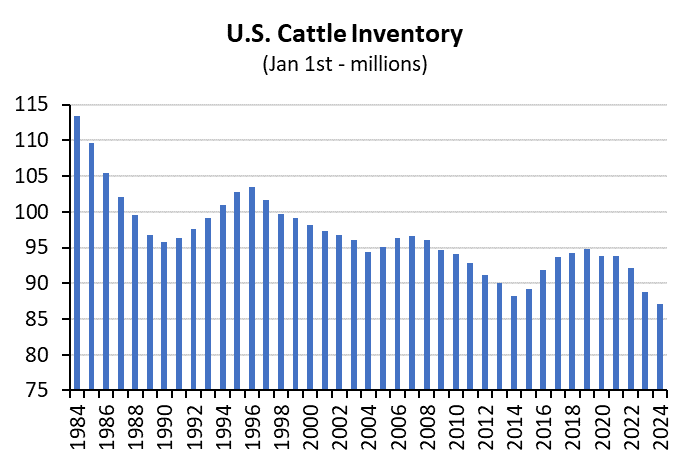

U.S. cattle numbers dropped again last year, according to USDA data released in January. As of January 1, 2024, total cattle and calves had fallen to 87.2 million, 2% lower than the same time last year. Cattle numbers have cycled higher and lower for decades, so five straight years of decline is not unprecedented. The continued decline is noteworthy, though, and reflects several challenges faced by cattle producers over the past five years.

The initial decline was sparked by poor profitability. USDA data show cow-calf returns dropped to approximately negative $200 per head in 2019 due mainly to low prices. Then, by the time prices recovered, a severe drought had developed over many of the key U.S. cattle-producing regions.

At the November 2022 peak, more than 75% of cattle in the U.S. were in regions affected by moderate drought conditions or worse. As pasture conditions deteriorated due to inadequate moisture, producers turned to hay and other feedstocks. However, hay production also dropped because of drought conditions. The combination of lower hay production and greater demand caused U.S. inventories to fall and prices to surge. Facing the reality of high feed costs and limited pasture availability, many producers reduced their herd size or sold out altogether.

Fortunately for cattle producers, above-average rainfall at the beginning of 2023 helped break the dry spell across many regions. By the summer of 2023, Montana and many Plains states saw the prevalence of severe drought conditions drop to almost zero. And by February of this year, less than 25% of U.S. cattle were located in drought-impacted regions, a sharp reduction from the 2022 peak. Producers have welcomed the improved conditions, but there are several reasons why a rebound in U.S. cattle numbers could be months or years away.

First and foremost, cattle have a longer gestation cycle than other livestock, putting a natural limit on how fast the U.S. herd can grow. And several regions continue to face weather or natural disaster-related challenges. For example, wildfires in February spread across nearly one million acres in Texas and parts of Oklahoma, one of the largest cattle-producing regions in the country. These fires consumed hay fields and pastures along the way. As a result, cattle producers in affected areas may have limited capacity to grow their herds. Beyond these factors, though, cattle producers also face a price dilemma. The smaller cattle herd has resulted in historically strong calf prices. Producers can now either sell their calves at high prices today or retain their calves to rebuild their herds for future sales.

Retail Beef Dollars Reaching Cow-Calf Producers

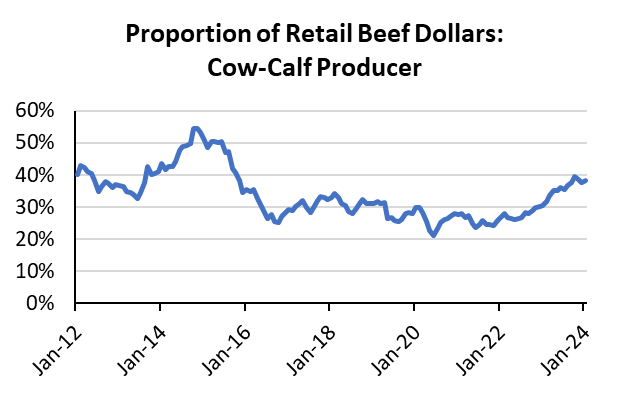

The decline in U.S. cattle numbers has directly benefitted producers who have been able to retain their cattle. Specifically, a lower supply of available cattle has led feedlot owners to bid more aggressively against each other to purchase calves from cow-calf producers. The dynamic also applies to beef processors, who have been forced to compete more aggressively against other processors to purchase cattle from feedlots.

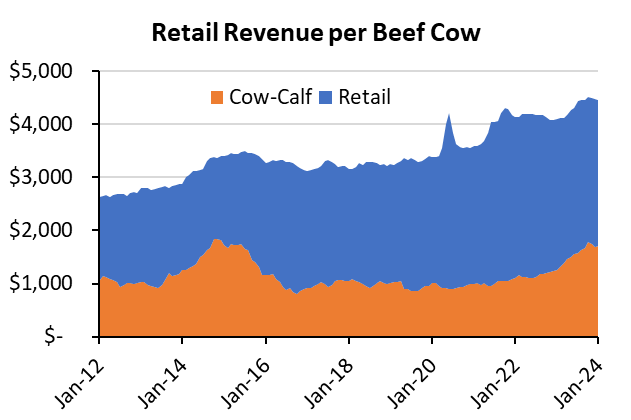

Cow-calf producers have capitalized on this dynamic by capturing a greater proportion of the total retail beef revenues. Retail beef prices have held up extraordinarily well over the past several years, bolstered by robust consumer demand. The average estimated retail value per cow surpassed $4,000 in May 2021 and has remained above that level ever since, peaking above $4,500 in 2023.

Historically, strong retail beef revenues have not translated directly to higher farm-level prices. Retailers, processors, and feedlot owners all compete with cow-calf producers to capture a portion of beef retail dollars. However, the competition for fewer cattle has led to a direct increase in the proportion of retail dollars captured by cow-calf producers. Cow-calf producers captured nearly 40% of retail beef dollars in late-2023. While below the peak of over 50% in 2014, cow-calf producers have benefitted from the greater competition for their animals during a period of strong retail beef prices.

Feedlot operators have benefitted from the shrinking beef herd as well. The proportion of retail dollars captured by feedlot operators rose to 22% in 2023, up from only 12% as recently as 2020. Combined, cow-calf producers and feedlot operators captured nearly 60% of beef retail dollars at times in 2023. Strong profitability for these segments of the beef supply chain has equated to financial pressure on other segments. In particular, those further up the protein value chain, including beef processors, saw margins turn negative at times over the last year because of the shrinking margin between the price of cows at slaughter and retail. Given the declining cattle numbers, these profitability dynamics could continue within the beef supply chain in 2024.

Lower Hay Prices Further Boost Beef Margins

To the delight of many U.S. livestock producers, hay prices have moderated over the past six months. The national average hay price peaked above $250 per ton in April 2023. The upward price trend had started in 2020 before accelerating in 2021 as drought conditions weighed on production. Total U.S. hay production dropped 5% in 2021 and an additional 7% the year after.

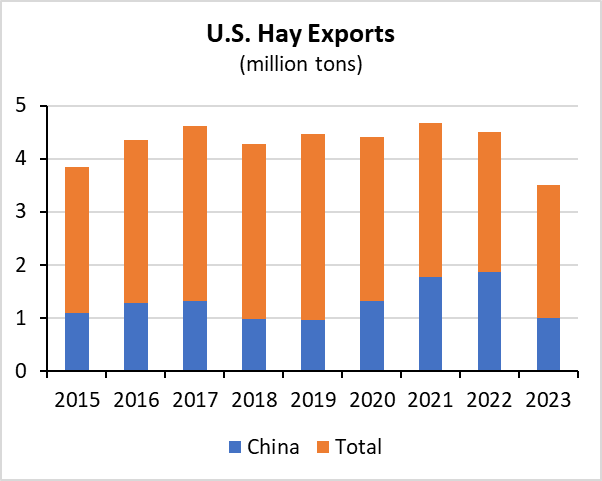

U.S. hay exports declined 22% last year to 3.5 million tons. The drop was due largely to a 44% decline in exports to China, which significantly reduced purchases in response to higher prices. Lower exports combined with improved growing conditions helped U.S. hay producers rebuild inventories. Hay production rose 6% in 2023, helping boost December 2023 stocks to 7% higher relative to the previous year.

Rising inventories have alleviated some of the pressure on prices. The USDA shows the national average hay price dropped to $189 per ton in January, nearly 25% lower than last April. Beef producers, both domestic and abroad, are likely to benefit if hay prices drop closer to historical averages. Hay constitutes a significant input cost for many producers, especially when drought conditions negatively impact pasture and grazing availability. As such, overall cow-calf producer margins could benefit from both continued strong revenues and lower input costs in 2024.

Conclusion

Cattle producers are well attuned to cycles in herd size and cattle prices. For many producers, the continued decline in cattle in the past five years has led directly to solid profitability. For others, this year may look like a continuation of previous years with challenges related to weather and natural disasters. Overall, though, the outlook for beef sector profitability remains strong in 2024.