Carbon Sequestration: Opportunities in an Uncertain Environment

Earlier this year, President Biden announced that the U.S. would seek to reduce its greenhouse gas (GHG) emissions by 50% between 2005 and 2030. While agriculture only represents 10% of these emissions, many policymakers see agriculture as an area with significant opportunities for emissions reductions via practices such as no-till farming or the use of certain cover crops. Farmers hoping to find additional revenue streams have found that private carbon markets are willing to purchase agricultural credits, or the right to emit a set amount of GHGs.

The challenge for producers is that the exact costs and benefits of these practices are not well known. Some private markets have noted that the inability to accurately quantify carbon sequestration from agricultural practices makes it difficult to exchange those credits. The good news is that the USDA is actively working towards supplying more specific details. In October, the USDA launched a $10 million initiative to quantify the carbon captured by various Conservation Reserve Program (CRP) acres. Combined with efforts to accurately measure the impacts of no- till farming and other production practices, the department is working to supply the information necessary to enable these transactions.

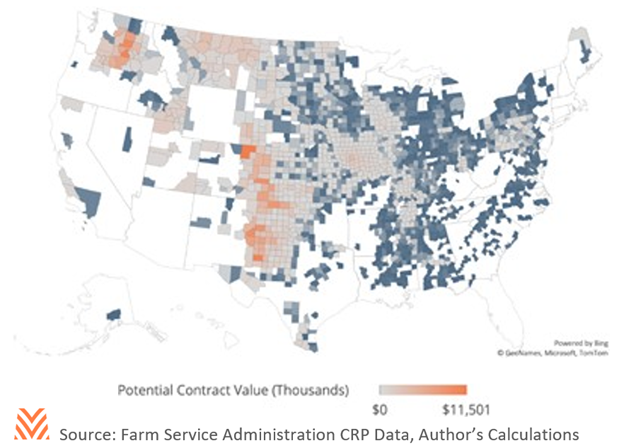

The potential for carbon markets may be alluring for some producers. Grassland CRP acres alone could offer a substantial revenue stream: a typical contract for grassland offers up to 1 metric ton per acre of grassland for a period extending five years. Meanwhile, current carbon markets in Texas are offering $10 to $20 per acre for these lands. This would imply that if all CRP grassland entered into similar agreements, grassland could supply up to 8 million credits per year with a total contract value of almost $700 million. The figure below shows how the revenues of this one program would be distributed.

This back-of-the-envelope example shows both the promise and peril of carbon markets. USDA researchers have said that pristine grassland could offer up to 5 times the carbon capture potential offered by exchange markets, but the potential needs to be explicitly quantified. Meanwhile, many exchanges only offer contracts for new practices, not existing ones. And a cost and benefit analysis from the University of Illinois found that the cost of entering a wide variety of carbon capture practices exceeded what could be earned from the current carbon exchange market.

Carbon markets as they stand today offer some promise, but there is considerable uncertainty. Producers must determine how they will engage with the exchange markets and must weigh the costs and benefits of doing so where very little information exists. But when the process is formalized, there could be significant opportunity for savvy producers. Demand for carbon credits is likely to increase as the U.S. approaches its carbon emission deadline and as more states abandon voluntary programs and switch to mandatory ones. Whether or not individual producers try to engage with the carbon markets, it will be increasingly important for their lenders to understand both the opportunities and risks of this new potential income stream.