Beefing with Imports

For most U.S. cattle ranchers, there is plenty to be thankful for in 2025. Live cattle prices hit new records in 2023. And then again in 2024. And then blasted through the previous record high again in 2025. The surge in prices has been a welcome reprieve for ranchers. It follows a challenging economic environment from 2015 through 2021, when packers and feedlots capitalized on a growing U.S. beef herd. Ranchers today are singing a different, more positive tune, but that is not to say there are no challenges.

Notably, not all ranchers are benefiting from record beef prices. Much of the price surge stems from a contraction of the U.S. cattle herd, as we previously discussed in the article “Raising the Steaks.” A significant factor behind the shrinking cattle herd has been intense drought conditions across many Western and Southern states over the past five years that forced many producers to sell off some or all their cattle. Those who exited the market are now unable to capitalize on today’s historic profitability.

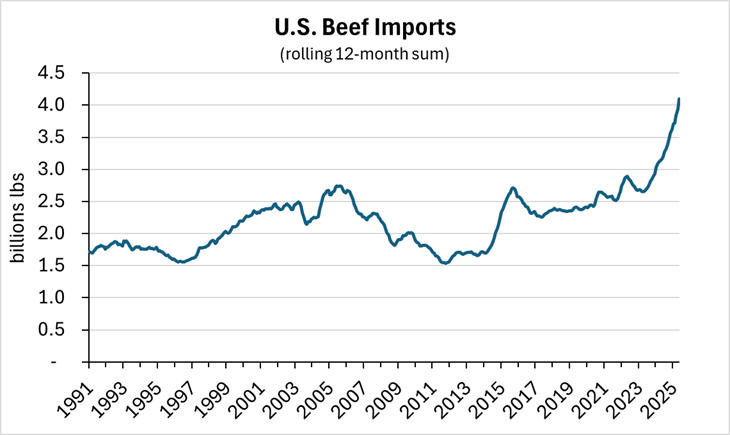

Another challenge that many beef producers cite today is a rising volume of imports. Indeed, beef imports have been growing at an unprecedented rate. The 12-month trailing total of U.S. beef imports reached 4.1 billion pounds in May, the most recent available data. This was the first time imports surpassed four billion pounds and marked a 54% increase since May 2023.

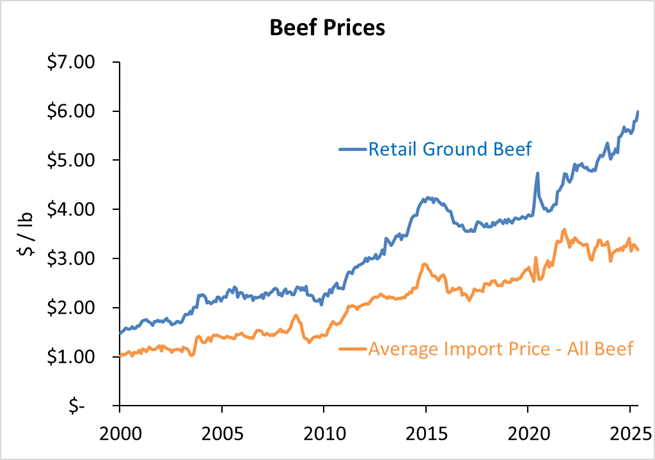

So, has the surge in beef imports helped put a cap on retail beef prices in the U.S.? It appears not. Retail ground beef prices have maintained a rapid ascent since 2021, with the national average reaching $6.12 per pound in June and remaining above $6.00 per pound since then. Historically, the ratio of retail ground beef prices to import prices has remained relatively consistent, but in 2025, that relationship has diverged. Retail ground beef prices are now nearly double the level of the average imported beef price, suggesting that even record-level imports are not significantly dampening retail price growth—or rancher profitability.

The NWS Monkey Wrench

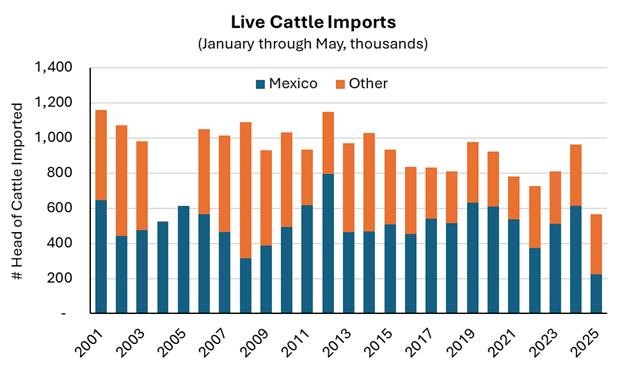

While imports of beef products have been on an explosive growth path, imports of live cattle have plummeted. According to the most recent data from the USDA, imports were approximately 66,000 head of live cattle in May 2025, a 67% decline from the previous year and the lowest May total going back to the 1980s. The culprit? A small but destructive pest: The New World screwworm (NWS).

This parasitic fly, notorious for its flesh-eating larvae that warm-blooded animals, such as cattle, are susceptible to, reemerged in Central America and Mexico in late 2024. In response, Mexico and the United States launched aggressive control measures, including aerial releases of thousands of sterile NWS flies, to curb reproduction of the wild NWS. While these efforts got underway, the U.S. also began imposing strict restrictions on live cattle imports from Mexico. Initially, this involved a full closure of imports in December 2024 before a partial reopening in January. This sequence was repeated in May 2025 when the border was again closed to live cattle imports from Mexico, with a phased reopening beginning in July.

The result of restricting live cattle imports from Mexico has been dramatic and clear. The U.S. cattle sector, already contracting, may now see a key source of live cattle drastically reduced in 2025. There is no clear timeline for a full reopening of the border to cattle from Mexico, as it will likely depend on the success of NWS control efforts. Instead, imports of cattle from Canada and processed beef from Mexico will likely increase in the near term. However, there are limits to beef imports as it must be processed in a USDA-certified processing facility to qualify for import into the U.S. As illustrated above, these facilities have already been working near capacity to meet the strong U.S. beef import demand over the past three years.

Import Outlook

The outlook for the U.S. cattle sector remains positive, a stance supported by the USDA’s July Cattle on Feed report. The U.S. cattle herd remains stubbornly in contraction mode, and signs of heifer retention rates increasing are yet to materialize in a meaningful way. Given the tight domestic inventories, and ongoing NWS outbreak in Mexico, it remains likely that beef imports will continue to play an important role in meeting domestic retail demand. This may pressure live cattle prices at the margins, but recent history has shown that live cattle and retail beef prices can both withstand pressure from rising import volumes.