Alternate Incomes From Solar Energy

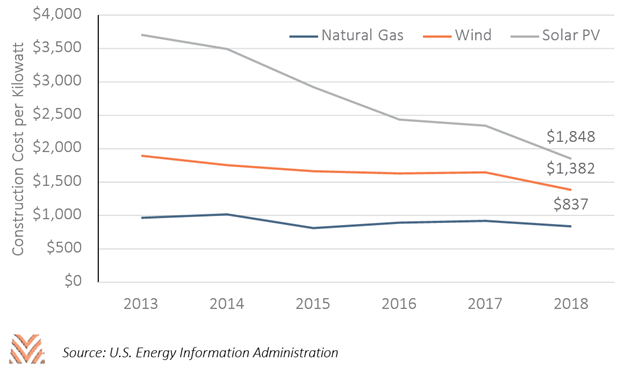

Between 2020 and 2025, the Energy Information Administration (EIA) predicts that more new electricity generation capacity will be added that is solar than that is oil and gas. Part of this stems from steep declines in installation costs on new solar projects. Between 2013 and 2018, the average cost per new kilowatt of solar photovoltaic (PV) generation fell 50%, rapidly approaching costs for other major energy sources. Solar is also unique in how distributed production is: 2% of solar production comes from end-users, like residences with solar rooftops or solar projects on farms.

Solar energy has been an avenue of alternative income for producers for years, but these cost reductions mean that farmers are likely to receive even more offers for solar leases. Long-term leases will almost always be above local cash rental rates, though amounts will vary depending on access to existing infrastructure and urban proximity. However, the length of these contracts means that producers must consider what could change over multiple decades. Commodity prices could drive cash rental rates above lease rates, developmental pressures could increase, tax structures could change, and business partners could falter.

A second option producers could take is to co-locate agricultural and solar PV infrastructure, known as agrivoltaics. Recent studies of agrivoltaics find that select commodities may even benefit from this co-location. In one study, the reduction of direct sunlight from the solar panels allowed specialty crops like tomatoes to retain more moisture, along with other ancillary benefits. In another, cows in fields with solar PV panels had lower internal temperatures as a result of standing under the panels, which aided milk production. Even shade-intolerant commodities like corn can co-exist well enough to increase total revenues from land, given appropriate solar infrastructure.

Whether or not solar could provide a useful income stream for a producer will depend on the specific circumstances of the land being considered. However, producers should expect to see plenty of opportunities to consider whether it is right for them over the next year. The EIA forecasts that the largest increase in total solar generation capacity will happen between 2021 and 2022. The amount of solar power generated by end users is forecast to quadruple by 2025. Even if producers do not decide to look to solar for alternate incomes, we are likely to see a surge in interest for these projects over the next five years.