Ag Trade in the Time of Tariffs

Ag Trade Deficit Persists

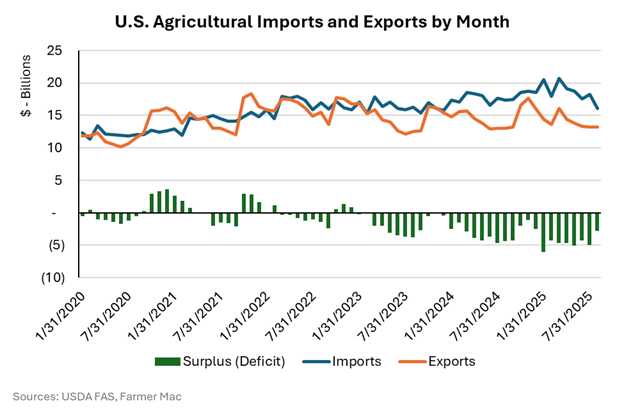

With the Trump administration’s pivot on trade policy and announcement of reciprocal tariffs in early 2025, agricultural trade has come into sharper focus. The desired effect of the President’s trade strategy is to boost exports and cut back on imports. While the strategy is still in flight, data through August 2025 shows a mixed bag of outcomes. According to USDA data, the value of agricultural imports has fallen precipitously since January 2025. The rapid price increases in coffee and cacao beans are the primary drivers of the early bulge in agricultural import values, but fewer purchases from Mexico and Canada have since compressed agricultural imports. Unfortunately, agricultural exports have also stagnated in 2025, driven by lower sales of soybeans, cotton, and rice to China. The chart below highlights recent trends in U.S. agricultural imports, exports, and the trade surplus or deficit.

Agricultural trade is a two-way street for U.S. farmers, ranchers, and consumers. On one hand, global markets are a major outlet for U.S. agricultural production. According to USDA data, roughly one in every five dollars of farm income is derived from a foreign buyer. America’s farmers, ranchers, and food processors are incredibly efficient, making more agriculture and food products in any year than we can possibly consume within our borders. On the other hand, U.S. consumers have a global and year-round palette. Americans increasingly consume more diverse food products, including fruits, vegetables, tropical products, and coffees. These products are not native to U.S. farm regions, are in demand year-round, and consumers show a low price-elasticity of demand. So even when fruits are out of season in the U.S., or prices are rising because of currency movements, Americans continue to buy these products. Grocers and importers are deeply aware of this demand, and thus agricultural imports have been on the rise for the last five years. Demand has been so strong in recent years that the U.S. flipped to an agricultural trade deficit for the first time in decades, and we have not exported more than we imported in value of agricultural trade in any single month since November 2023.

Agricultural Export Winners and Losers in 2025

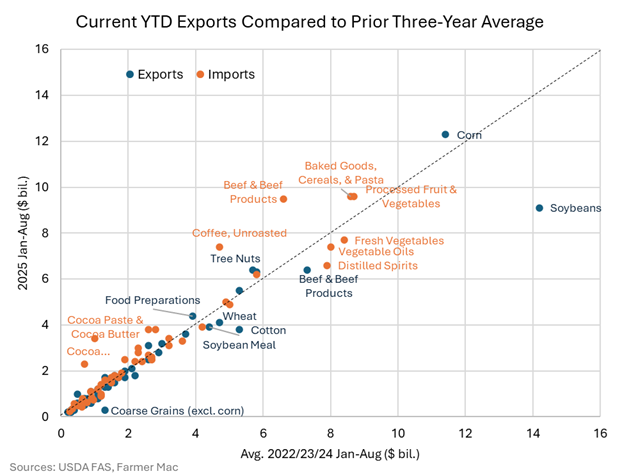

Like any economic system, some industries and producers are faring better, and some are faring worse, under the current trade policy pivot. For U.S. producers looking to export markets to drive demand, most commodity producers are having an average year. According to USDA data, half of the major agricultural trade categories are within plus or minus 10% of their three-year average in total sales. Large deviations from recent experience are sometimes above-average (corn, tree nuts, dairy, and food preparations), and some are below-average (soybeans, beef, wheat, cotton, and soybean meal). The most notable deviation is soybeans, as highlighted in the chart below. China’s well-publicized pullback in U.S. soybean purchases is the primary driver. For producers competing with agricultural imports, fresh vegetables, vegetable oils, and distilled spirits have seen the greatest declines from recent years. This reduction in imports could spur demand for domestic products, providing a tailwind for these producers. Coffee, cocoa, prepared baked goods, and beef show the greatest increases compared to recent history.

The Bottom Line for Lenders

The evolving landscape of U.S. agricultural trade—marked by persistent deficits, shifting export dynamics, and volatile import patterns—presents both challenges and opportunities for agricultural lenders. As trade policies continue to reshape market access and commodity flows, lenders must remain vigilant in assessing borrower risk, especially for producers exposed to export-dependent crops like soybeans or those benefiting from reduced import competition. Trade deals inked in the coming months could provide tailwinds to commodity prices and profit margins, but until grain-filled ships are in the water, uncertainty is the name of the game. The current environment underscores the importance of flexible lending strategies, robust risk management, and a deep understanding of both global trends and local realities. By staying informed and adaptive, agricultural lenders can help their clients navigate uncertainty and position themselves for resilience and growth in a rapidly changing trade environment.