A Farm Income Upswing amid Tariff Turbulence?

The USDA surprised many agricultural sector observers in February by forecasting Net Cash Farm Incomes (NCFI) to increase 30% in 2025 compared to last year. Prices for many commodities trended lower throughout 2024 while input costs remained persistently high, causing some analysts to guess that the USDA might project a decline. Interestingly, the largest factor driving the increase this year was a function of the farm economy in previous years: government payments. As of February, government payments are projected to quadruple in 2025 to over $40 billion, the sharpest annual increase on record.

Analyzing the exact shape of the sharp increase in government payments will be left to a future Feed article, as full details have yet to be released on the aid payments authorized in the American Relief Act of 2025. For now, removing ad hoc government payments from the 2025 NCFI forecast indicates that the farm economy in 2025 may be similar to its condition in 2024, which necessitated ad hoc payments in December 2024.

It’s worth bearing in mind that the USDA’s forecast was released in early February, only weeks after the new administration took office. Furthermore, the February forecast was largely based on data from November through January and does not reflect the recent changes to trade policy that began in April.

So, what does the recent turbulence surrounding tariffs and counter-tariffs mean for the agricultural sector? A survey of agricultural economists last fall indeed predicted that widespread tariffs would lead to economic harm to agricultural producers. Approximately 86% of economists expected a Trump administration would hurt U.S. trade, predicting that the campaign’s plans to enact U.S. tariffs would lead to counter-tariffs from other countries that target U.S. agricultural exports.

And the Market Response to Tariffs Was….?

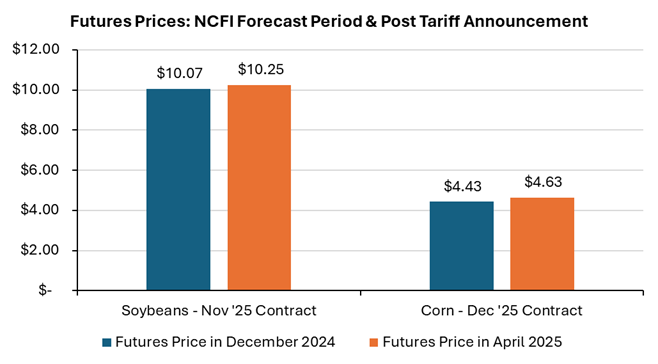

Given expectations for tariffs to crater foreign demand and slash prices of agricultural commodities, it may come as a shock that prices for many commodities increased throughout April relative to the levels on April 1. The futures price for 2025 corn increased over $0.20 per bushel (4%) in the weeks following the U.S. tariff announcement. Soybean prices have more than recovered from the initial steep drop that occurred in the days following the announcement, as have some livestock prices, such as pork. There is less granular data on specialty crops, but anecdotal evidence suggests some tree nut, fruit, and vegetable prices have increased modestly. However, several commodities have experienced price declines, including cotton, dairy, and wheat. The mixed impact highlights the complexity of factors that determine commodity price movements.

So, What’s Driving Prices?

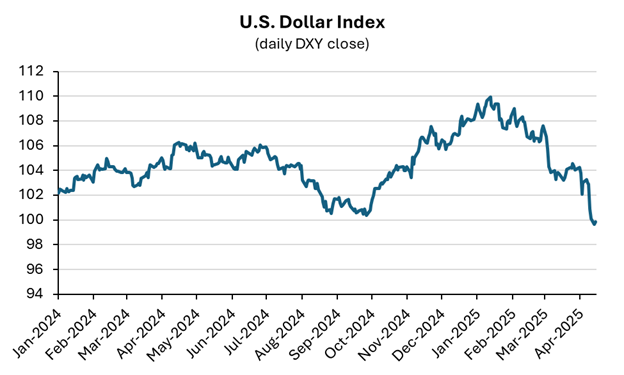

Perhaps the largest driver of movements in commodity prices over the past several months has been fluctuations in currency strength. The strength of the U.S. dollar (USD) has a significant impact on commodity prices due to the role of exports. A stronger USD can make U.S. agricultural exports more expensive relative to the same commodities being sold from competing countries. This then puts downward pressure on domestic prices in the U.S. to bring prices into parity with global markets. The reverse can also be true, meaning a weak USD can help boost domestic prices.

The USD has weakened considerably in 2025, helping offset some of the negative pressure from other factors. A broad index of USD strength shows the dollar has dropped 9% year-to-date through May 1, and 4% in April alone. Dollar strength, like commodity prices, is influenced by myriad factors. Inflation expectations, differences in global interest rates, debt issuance, trade relationships, and numerous other variables play an important role in determining movements in USD strength. The trend of a weakening dollar started prior to the new administration, but picked up additional steam in April as markets digested what sharply higher U.S. tariffs might mean for trading relationships with the U.S. In the meantime, the continued decline in dollar strength provided a boost to commodity prices.

So, Which Way for Farm Incomes?

The USDA updates its NCFI forecast three times per year, generally in February, September, and December. As such, it will be several months before the USDA reveals what impact the shift in global trade policies, including those implemented by the U.S., is projected to have on NCFI.

A knee-jerk reaction might be that the USDA is likely to reduce its forecast for NCFI in September. The reality is that numerous factors influence farm sector revenues and profits. Domestic consumption plays a critical role for some commodities and is flat year in and year out. For other commodities, demand can fluctuate year to year based on the strength of the economy, wage growth, or other factors. Finally, for some commodities, exports are the key demand source. A negative shock to export demand due to changing trade policy may indeed put downward pressure on prices and NCFI, while a weaker currency can more than offset the price impact of tariffs. New trade deals with several export markets are also a real possibility between now and the next NCFI update later this year. Ultimately, the new administration has been very vocal about supporting farmers financially through any trade volatility. If this is the case, the September NCFI might even include a larger government payment forecast than the February release.