A Big Step Higher, a Small Step Down for Farm Incomes

Outlook for 2023 Farm Incomes

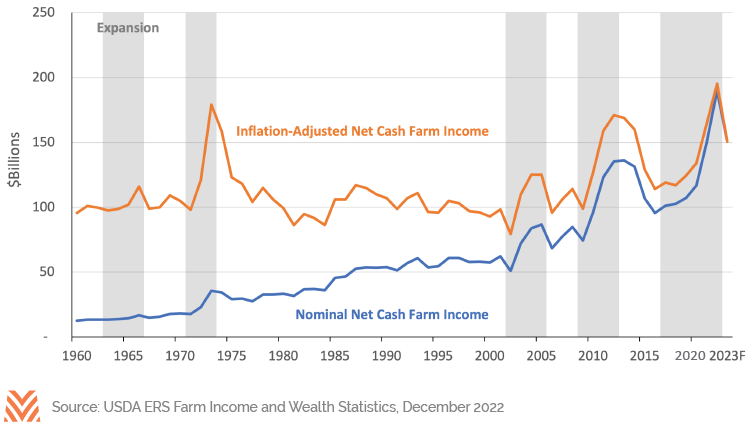

In February, the USDA released its initial projections for 2023 farm sector financials. The report contained both positive updates regarding farm finances last year along with a subdued outlook for the year ahead. While Net Cash Farm Income (NCFI) has risen for six consecutive years, the USDA projects it will drop 21% year-over-year in 2023. The projected decline, if realized, signals an end to one of the most profitable periods for U.S. farmers in decades. However, the decline in many ways reflects how abnormally profitable 2022 was within the agricultural sector. NCFI rose to a record level in 2022, propelled by robust export demand and a rebounding global economy. Even accounting for inflation, 2022 NCFI surpasses all previous highs, including the 1970s and early-2010s. So, while the forecast decline in 2023 is significant, it isn’t too surprising: it was unlikely that farm incomes could rise further from such an extraordinarily high level.

The forecast decline in 2023 NCFI is due to both lower revenues and higher costs. Producers in most agricultural sectors benefitted from a surge in prices and cash receipts last year. In 2022, year- over-year crop and livestock receipts increased by 24% and 19%, respectively. Global inventories of most agricultural commodities were relatively tight entering 2022. This set the conditions for a subsequent spike in prices when Russia invaded Ukraine in February. The timing benefitted U.S. producers, as many had already locked in input costs ahead of Russia’s invasion but had yet to lock in the price of their grain. The result was historic profitability. However, commodity prices have trended lower after peaking in mid-2022. Favorable growing weather in the U.S. and South America last year along with a Russia-Ukraine grain treaty have helped alleviate the global supply crunch and started a trend of lower commodity prices. In 2023, year-over-year crop and livestock cash receipts are forecast to decline by 3% and 6%, respectively.

Contrary to farm revenues, expenses are forecast to increase in 2023. Cash expenses jumped nearly 20% in 2022 as global energy prices surged. Total fertilizer and fuel expenses jumped 44% year-over-year in 2022. Energy prices have since declined but have been offset by rising feed, seed, and pesticide costs. Higher interest rates are also weighing on producer margins this year. Actions by the Federal Reserve to combat high inflation have led to a sharp uptick in short-term borrowing costs. Total interest expense on non-real estate farm loans is forecast to increase 45% this year relative to last year.

Acknowledging lower revenues and higher expenses, net farm incomes are still projected to be elevated this year. The current forecast shows NCFI will remain 21% above the previous inflation- adjusted 30-year average. This forecast remains unrealized and future updates may be influenced by the Russia-Ukraine war, South American production, and a potential recession this year, among other factors. Still, the current forecast suggests that another year of strong sector profitability is likely.

Farm Balance Sheet

The surge in recent incomes has bolstered farm sector balance sheets. Between 2018 and 2023, farm sector assets increased by 34% to just over $4 trillion. The underlying factor has been the strong growth of farmland values. Farmland constitutes approximately 80% of farm sector assets. Changes in values can therefore have outsized impacts on producer balance sheets. Over the same period, equity increased by nearly $900 billion dollars on the farm sector balance sheet.

Acknowledging these tailwinds, higher farm expenses this year will put modest pressure on farm finances. The USDA projects that farm sector working capital will decline 12% year-over-year in 2023. Working capital has historically tracked farm incomes as assets are banked during profitable periods and spent when margins are squeezed. Therefore, declining working capital provides another signal of tighter financial conditions. One key difference to the last broad decline in working capital is the current interest rate environment. Farmers were able to utilize short-term financing at relatively low interest rates when working capital declined from 2014 to 2018. However, the average interest rate on agricultural production loans is 48% higher today than during that period. Therefore, producers that do not have the working capital to self-finance their operations face significantly higher operating costs.

Declining Government Payment

Favorable commodity prices and incomes are projected to contribute to a sharp decline in direct government payments to farmers in 2023. Government payments are projected to drop 34% year-over-year in 2023 to $10.2 billion. Adjusted for inflation, this would be the lowest level since 1982, just prior to the onset of the 1980s Farm Crisis. Government support peaked in 2020 at nearly $46 billion dollars, due largely to ad hoc programs intended to offset the COVID-19 disruption and trade dispute with China.

This pivot away from government payments dictating farm incomes is generally viewed as a positive development for the agricultural sector. Government payments are an important support mechanism for the food and agriculture sectors, but if support payments are too high, it can be a sign of structural or market problems for producers. Government support as a proportion of NCFI is projected at the lowest percentage since the early-1980s. Furthermore, nearly 40% of government payments in 2022 are attributable to conservation programs, many of which didn’t even exist until recent decades. Government payments could rise in the years ahead if commodity prices decline. Whether or not this occurs, relatively low government payments in 2023 should help reverse some criticism of high government payments to farmers in 2020 and 2021. Solidifying support for agricultural sector programs will be key for the Farm Bill negotiations that began earlier this year.

In Conclusion

Farm cash flows are expected to decline in 2023 as farm revenues retreat from historic levels. Still, the health of the agricultural economy remains strong. Farmland values are up following six years of rising farm incomes. Meanwhile, government payments have dropped as pandemic-era programs expire, and the necessity for additional payments has waned. Rising interest rates and higher operating expenses will undoubtedly lead to tighter profit margins for many producers. Looking ahead, commodity prices may remain volatile due to geopolitical events, but robust farm balance sheets reduce the risk of a significant uptick in farm sector stress or an immediate downturn in farm loan performance.