Is Agriculture Better Prepared to Weather the Rapid Rise in Interest Rates?

AgWeb

By: Tyne Morgan

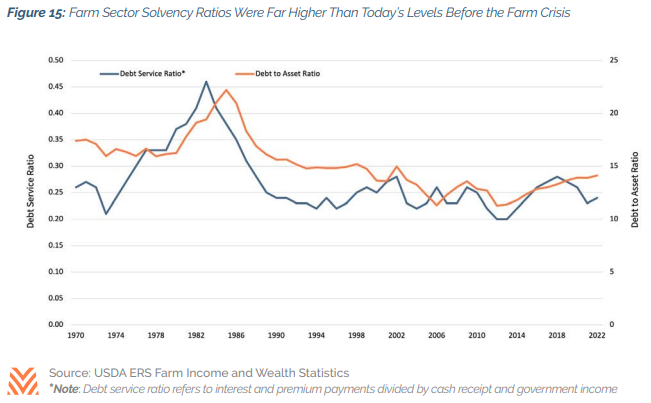

The main signal that agriculture is in a better position than it was 40 years ago is leverage. “The Feed” shows the total sector debt-to-asset ratio has averaged 10% to 15% since the early 2000s, compared to 15% to 23% during the farm financial crisis. (Farm Journal)

Interest rates are rising rapidly. U.S. gross domestic product (GDP) saw contraction two months in a row. The warning signs about the health of the general economy are blaring, but the health of the farm economy seems to be on solid footing with ag lenders in a strong position to help farmers and ranchers weather the higher costs.

The summer issue of “The Feed” by Farmer Mac acknowledges the current agricultural economy has some resemblance to the economy leading up to the Farm Crisis of the 1980s. However, economists point out there are key differences that indicate 2022 is different. As a result, Farmer Mac says agriculture is in a strong position and far better prepared to withstand a possible downturn.

Just this week, the Federal Reserve raised interest rates by 0.75 percentage points. This was the second consecutive month the Fed made such an aggressive move. While the Fed is working to battle inflation, the immediate impact on farmers will be higher operating costs.

“If you have a line of credit with a bank or another lender, and that interest rate is set to interest rates that can fluctuate throughout the year, so either a revolving line of credit or some sort of adjustable rate, that’s where it’s going to show up first, because those short-term rates are moving up very rapidly,” explains Jackson Takach, chief economist for Farmer Mac. “If that interest rate is tied to an adjustable rate, you could see immediate impacts in your cost. Now, it’s not going to be devastating, we have a lot less of farm debt that is tied to an adjustable rate today than it was in, say, the 1970s. So, it’s less impactful.”

What longer-term impacts could sprout form higher interest rates? Takach says there’s no doubt farmers will see impacts on everything from land to other long-term investments, but the situation still isn’t as costly as what agriculture saw during the Farm Crisis.

“People think about more long-term impacts of my investment in agriculture in terms of what is my return or what is my cost on buying that piece of land or selling that piece of land, and higher interest rates raises that cost of capital for farmers, either existing farmers, people who want to get into farming as an investment or as a new farmer,” he says. “All of those three big things are somewhat negative. However, the interest rates, if you look at the total span of time, these interest rates are still not anywhere near what we experienced in the 1970s or 1980s. So, there’s still a lot of really profitable farming happening despite higher interest rates.”

Reading Into Current Debt-to-Asset Ratios

The main signal agriculture is in a better position than it was 40 years ago is leverage. “The Feed” shows the total sector debt-to-asset ratio has averaged 10% to 15% since the early 2000s, compared to 15% to 23% during the farm financial crisis.

“As Dr. Zhang noted in our last edition of The Feed, over 80% of Iowa farm ground is debt free, a trend that likely extends to other grain belt states,” says Zachary Carpenter, executive vice president and chief business officer at Farmer Mac. “While the overall level of farmland debt has increased, the number of farms with debt has decreased during this period, partly due to continued farmland consolidation. This decline is also a function of changes in lending standards and practices.”

Farmer Mac points out from an agriculture lending perspective, the industry is dominated by the Farm Credit System and commercial banks, which combined represent nearly 70% of total agricultural real estate lending and over 60% of operating lines.

“While structurally different (cooperative versus deposit-taking), both are in a much-improved position than in prior years. Partly, this reflects continued consolidation. Active agriculture banks have decreased by over 70% since the late 1970s to just over 1,200 today. The Farm Credit System continues to consolidate, with total banks and associations down 37% since 2000 and with another round of large mergers announced this year. Meanwhile, financing institutions are more diverse than ever, creating scale and risk mitigation across larger, diversified portfolios,’ Carpenter says.

Farmer Mac says another component of lending financial health reflects increasing capital and liquidity levels. Agriculture banks averaged equity capital ratios around 8% during the 1980s. Current levels on average are closer to 12%.

“The Farm Credit System overall is significantly more capitalized, currently averaging 15% equity capital ratios, which is more than double the equity capital ratios during the farm financial crisis,” Carpenter says. “More importantly, these entities are holding significantly more liquidity to mitigate severe and prolonged capital market crises. The Farm Credit System banks’ liquidity position at the end of 2021 (cash and eligible investments) was $81 billion, or 23% of total debt, providing 175 days of liquidity to cover maturing debt and borrowings. This compares to a mere 20 days of liquidity in the 1986 to 1987 period.”

From drought impact to the agricultural impact of the crisis in Ukraine, Farmer Mac economists explore the changing dynamics in the summer edition of The Feed.

To view the full article, click here.