Global factors forecast to suppress exports

Agri-View

By: Gregory Lyons, Farmer Mac

Agricultural prices are predominantly driven by exports. Exports led price surges in the 1970s, 1990s and late 2000s. The spikes were caused by a series of macro-economic factors in addition to changes in agricultural production. While these periods weren’t identical they shared many macroeconomic themes — a strong economic environment and a depreciating U.S. dollar that led to export growth. With the world now in a recession many of the same factors will be working in the opposite direction, suppressing agricultural exports and profitability through the downturn.

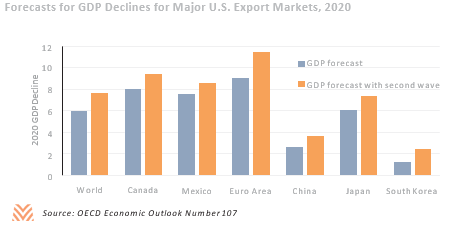

Global growth is important to U.S. agriculture because it increases disposable income and creates new markets for American products. Negative or slow growth has historically led to decreased demand for animal proteins and a reduced need for crops through impacts on feed. Growth in gross domestic product will be negative 6 percent, or almost negative 8 percent if a substantive second wave of COVID-19 cases emerge, forecasts the Organization for Economic Cooperation and Development.

The emerging economic downturn won’t be even across major agricultural markets. Canada and Mexico accounted for about 30 percent of U.S. agricultural exports in 2019 and are both forecast to see sharper declines in GDP growth than the global average. The Eurozone represents another 9 percent of exports and will see some of the world’s sharpest declines. Spain, France and Italy are all forecast to have declines between 11 percent and 14 percent.

While growth expectations in China have significantly declined, the forecast is for only a mild contraction in 2020. South Korea’s ability to curb the spread of infection also has resulted in lower expected declines in GDP. Japan’s economy has slowed in recent years. The forecast is for greater contraction in 2020.

Regional variation will place unique pressure depending on commodities imported. In 2020 Europe imported almonds, representing about 15 percent of the goods by greatest value. Canada imported more fresh fruits and vegetables while Mexico’s main imports from the United States were corn and soybeans. Beef and pork are the main exports to Asian nations where GDP isn’t expected to experience much decline. That could provide some insulation for animal products, though they’ll face more headwinds from GDP declines in emerging markets.

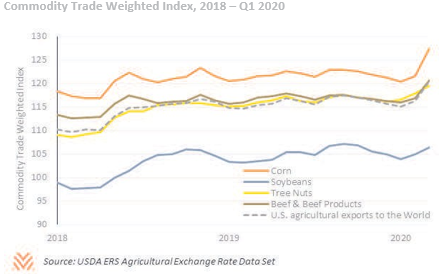

Stronger dollar reduces competitiveness

A stronger U.S. dollar reduces the competitiveness of American commodities. Since March the dollar has appreciated against several currencies. That appreciation will have disparate impacts on commodities based on how the dollar has appreciated against the currencies of countries that either import or export goods. For corn, the dollar surged against the Mexican peso and Brazilian real in March. That has weakened U.S. competitiveness.

Near-term forecasts indicate that currencies for major agricultural exporters such as Russia and Brazil will continue to depreciate relative to the U.S. dollar. Weak oil prices will continue to place pressure on the ruble and are unlikely to change in the short term. In Brazil the pandemic accentuated pervasive structural issues that have caused depreciation against the dollar.

But forecasts are stable for major dairy- and meat-producing regions such as the European Union or New Zealand. That could provide some stability for animals and animal products while weighing on major cash grains.

Energy costs are closely tied with U.S. agriculture costs. The largest impact stems from biofuels. As biofuel prices increase so does the profitability and use of agricultural products such as corn or sugar cane. But low energy costs also lower farm expenses and prices for wheat, soybeans and other commodities.

The currencies of Russia and other “petro states” are closely linked to oil prices. As oil prices decline those currencies depreciate, increasing their competitiveness against American goods. The price of West Texas Intermediate crude through 2021 won’t return to pre-pandemic levels, forecasts the U.S. Energy Information Administration.

There are myriad other ways the global economy could influence American agricultural exports. Population growth is the most important driver of total exports. It slows during recessions. The costs of government response to COVID-19 could leave nations unable to fully fund agricultural research, which could lead to less productivity in the future. But low inflation and robust government policies may partially offset anticipated declines.

U.S. farmers are closely intertwined with the global economy even when not accounting for foreign agricultural production. Through at least 2021 producers will need to work in an environment with contracting economies, low oil prices and a stronger U.S. dollar. But not all commodities or markets will be impacted the same. Global pressures will be strongest for commodities such as corn and wheat. Animal proteins and consumer-oriented goods are typically most at risk during downturns. But they may see some support due to where those commodities are produced and purchased. The 2020 outlook may be poor. But if producers can withstand the current growing season, many global factors should once again be working in their favor for the next crop marketing year.

The preceding article was reprinted with permission from Farmer Mac’s “The Feed.” Visit farmermac.com/thefeed for more information.

To View Full Article: Click Here