Farmer Mac: It Trades Like A Bank But Is Far Better; This Stock Should Be A Double

Seeking Alpha

By: Gary J. Gordon

Summary

- Farmer Mac delivered another great quarter. Well on its way to earning $9 per share this year.

- Farmer Mac trades like a bank, but it significantly outperforms them.

- Farmer Mac has durable competitive advantages and manages those advantages well.

- The stock is silly cheap at a 7 P/E and 4.6% dividend yield. A valuation that reflects the company’s strengths makes it a double.

Lots of things are going on right now. Time is scarce. So, I’m going to make this easy. Four points about Farmer Mac (NYSE:AGM), my favorite stock:

- It just reported another excellent quarter.

- It trades like a bank, but on most key measures, it is better than a bank.

- The three reasons why it can consistently deliver strong earnings and dividend growth.

- How cheap this stock really is.

Farmer Mac reported another excellent quarter

Here are the highlights:

Operating EPS was $2.57, up 18% year-over-year (YoY). Operating EPS year-to-date is $6.88, putting Farmer Mac comfortably on its way to earning over $9 per share this year.

The core interest margin was 96 bp, over Farmer Mac’s target of 90 bp. Farmer Mac benefited from the Federal Reserve’s low interest rates, unlike the banks (see below). It is also focusing more on higher-return assets like farm mortgages and rural alternative energy loans, as opposed to loans to other farm lenders.

Chargeoffs (actual loan losses) were $0. That’s right, zero. Nada. They have totaled only $400,000 year-to-date, or about 2 bp. Find another lender that low. It probably doesn’t exist.

Operating expenses were 25.6% of revenues, down from 28.2% a year ago. Farmer Mac says not to expect improvement ahead, but like a lot of companies, it cancelled a lot of travel, etc. due to COVID-19.

Preferred stock dividend cost common shareholders $0.48 per share versus $0.32 the prior year. Farmer Mac issued two preferred stocks this year just to be super-cautious and finance more growth.

Farmer Mac trades like a bank, but on most key measures, it is better than a bank

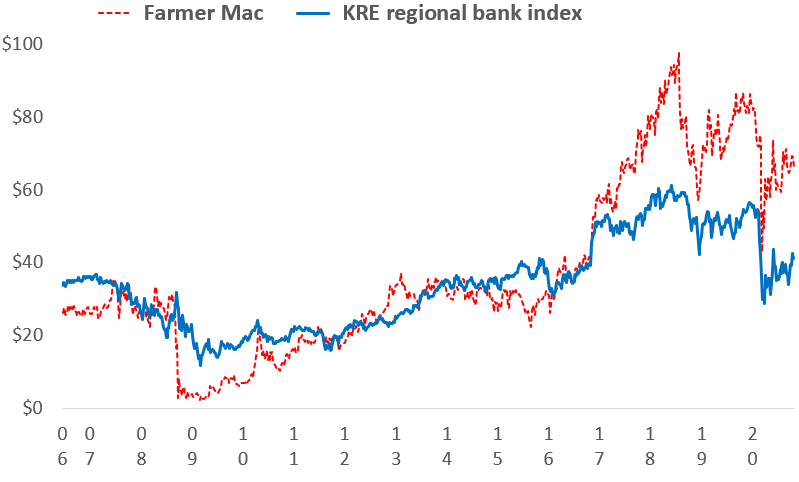

This chart compares Farmer Mac’s stock price to regional bank ETF KRE.

Source: Yahoo Finance

The correlation is remarkably close – an R² of 85% since 2006. So, investors firmly place Farmer Mac in the bank category. But let’s compare the financial performance of Farmer Mac versus a random sample of regional banks – Synovus (NYSE:SNV), Webster Bank (NYSE:WBS), People’s United (NASDAQ:PBCT), and Zion Bank (NASDAQ:ZION):

- The banks have averaged a 7% ROE since 2010. Farmer Mac is over 15%.

- The banks have averaged a chargeoff rate of 54 bp. Farmer Mac is 2 bp. And, chargeoff rates are higher for the banks this year than last year. Farmer Mac is flat.

- Low interest rates this year cost the four banks an average of 31 bp off their interest margins for Q3 versus 2019, or 13% off interest income. Farmer Mac’s interest margin rose by 6 bp, and its interest income rose by 19%.

Farmer Mac not only has less credit and interest rate risk than banks, but less competitive challenges as well. The banks are now beset by fintechs who are unburdened by expensive and increasingly obsolete bank branch systems. And like other New Age companies, the fintechs are generally unburdened as well by a profit motive, at least for now. That makes for fierce competition. Farmer Mac? Same old, same old.

The three reasons why Farmer can consistently deliver strong earnings and dividend growth

First and foremost, Farmer Mac is a federally chartered corporation with an implied federal government guarantee on its debt. This gives Farmer Mac cheaper debt costs than its peers. That is a huge competitive advantage for a financial company.

Second, the federal government has a long-held policy of providing financial support to farmers, on the theory that we all like to eat and farmers make that stuff we eat. In recent years, the normal farm subsidies were supplemented by trade war and COVID-19 money. As a result, Farmer Mac said on its Q3 conference call that despite COVID-19 disruptions farm income will increase this year, and land prices are holding steady.

Third, Farmer Mac has used the above two benefits to maintain that low risk credit, interest rate, and capital profile, while growing assets in the high single digits.

Farmer Mac’s stock price is embarrassingly cheap

I know that, at successful enterprises, the customer is always right. But, come on, investors. Farmer Mac went into its earnings report with a $70 stock price, and only that high after a $5 a share benefit from Monday’s Pfizer (NYSE:PFE) Rally. That puts Farmer Mac’s valuation at a 7 P/E on 2021 EPS of around $10, and at a 4.6% dividend yield. That P/E ratio is only 30% of the S&P 500. And only 60% of the four regional banks. That is not right.

Yet, Farmer Mac’s competitive advantage is durable, its long-term EPS growth outlook is very likely better than the S&P 500 and the banks, and it probably has less earnings risk. Reaching the banks’ current average P/E ratio of 11.8 puts Farmer Mac’s stock price at $118, or up nearly 70%. But, as I’ve said, Farmer Mac is better than a bank.

My target price is $150, or more than a double from here. And if that price takes some time to achieve, you get paid to wait. The next dividend increase is likely to be to $3.60, giving you a 5% yield. Beats the banks again, right?

Disclosure: I am/we are long AGM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

To View Full Article: Click Here