Credit Quality Remains Top Ag Lender Concern

ABA Banking Journal

By: Tyler Mondres

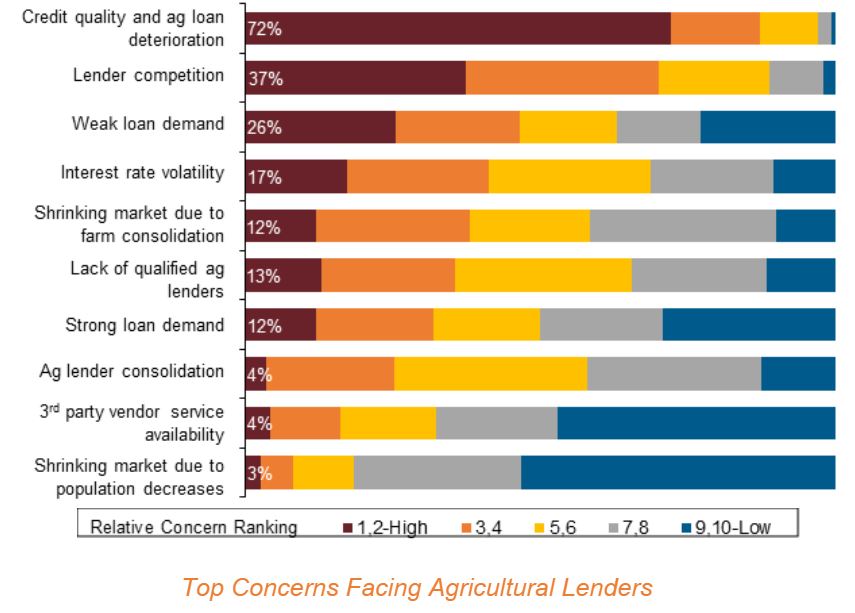

As the farm economy continues to work through a prolonged downturn amid a global economic slowdown, agricultural lenders remained primarily concerned with the same factors for themselves and their borrowers as they did last year, according to the joint ABA-Farmer Mac 2020 Agricultural Lenders Survey report. For ag lenders, credit quality and the deterioration of agricultural loans, competition from other lenders and weak loan demand remain the top three concerns. For producers, lenders continued to be most concerned about the liquidity, income and leverage of their ag borrowers.

Credit quality and the deterioration of agricultural loans (72.1 percent ranked among their top two concerns) remained the number one concern facing lenders in 2020. This sentiment was shared by respondents from institutions of all sizes and across all regions (northeast, south, plains, cornbelt, and west)—including lenders from the south, who identified competition with other lenders as their primary concern the previous two years.

Competition for lending opportunities (37.3 percent) was the second-highest ranked concern overall among all lenders. A majority of lenders (78.9 percent) ranked the Farm Credit System as their top competitor for agricultural loans. More than two-thirds (66.9 percent) ranked community banks within their top two competitors, followed by vendor financing (17.1 percent), regional banks (8.9 percent), and credit unions (8.0 percent).

While more than half of lenders (57.7 percent) say there has been no change to the competitive landscape since March, 22.5 percent say competition has become more aggressive since the onset of the pandemic and resulting economic disruption. Lenders in the south were most likely to report no change (82 percent). Thirty percent of lenders from institutions between $500 million and $1 billion in assets, as well as a quarter of lenders in the Great Plains, said that competition became more aggressive.

Weak loan demand was a prominent concern as well. More than a quarter (25.5 percent) listed weak loan demand among their top two concerns. This was shared across most regions, with the exception of lenders in the west and at institutions with assets greater than $1 billion. Weak loan demand was most concerning in the northeast (50 percent among top two concerns), the south (31.6 percent) and at institutions with assets between $500 million and $1 billion (34 percent).

Lenders also reported nearly identical concerns for producers in 2020 as in prior years. Lenders were most concerned about liquidity issues for producers. More than half (51.4 percent) listed it as their top concern. Concern about farm incomes levels was close behind, with almost a third (32.2 percent) flagging it as their top concern for ag borrowers. Total leverage was the third most common concern, with almost half of respondents (45.6 percent) ranking it among their top four concerns.

To View Full Article: Click Here