Choices Magazine, a publication of Agricultural & Applied Economics Association

1st Quarter 2018 • 33(1)

Monetary Policy and Agricultural Commodity Prices: It’s All Relative

Jason Henderson

Jason Henderson (jhenderson@purdue.edu) is Associate Dean and Director of Extension, Department, Purdue University, West Lafayette, IN.

U.S. macroeconomic policy is in transition. After the recent “Great Recession,” the Federal Reserve Bank and other central banks across the world slashed short-term interest rates to historical, near-zero lows. Today, the Federal Reserve Bank has begun the process of normalizing rates. After bottoming out at 0.25%, the target range for the Fed funds rate rose to 1.5% in December 2017, with projections for additional increases in the future. In addition, the Federal Reserve has begun to shrink the assets it accumulated on its balance sheet in response to the Great Recession to trim the money supply.

Research has shown that changes in real interest rates and the money supply influence commodity prices. More accommodative monetary policy—which reduces interest rates and builds larger money supplies—tends to increase commodity prices. Less accommodative monetary policy—which raises interest rates and shrinks the money supply—tends to depress commodity prices. Monetary policy changes tend to affect commodity prices directly by altering demand for storable commodities, such as agricultural commodities. Through its influence on exchange rates, changes in relative interest rates can also affect agricultural commodity prices.

Although these channels have been widely known, research has also identified mitigating factors that can affect the size of these macroeconomic impacts. Specifically, inventories of agricultural commodities alter the responsiveness of agricultural commodity prices to macroeconomic fluctuations. While low inventories intensify exchange rate impacts on commodity prices, large inventories temper exchange rate impacts. In sum, higher interest rates typically place downward pressure on agricultural commodity prices, but the supply and demand dynamics of agricultural markets shape these impacts. Thus, as farmers and other agricultural stakeholders incorporate the influence of monetary policy in their strategic planning, they also need to recognize that commodity prices may not fall just because interest rates rise. The impacts depend on monetary policy in other countries and agricultural market dynamics.

Monetary Policy and Commodity Prices

Economists have long known that macroeconomic policy affects agricultural commodity prices. Interest rate, money supply, and exchange rate shifts affect agricultural prices through an overshooting process (Dornbusch, 1976). Due to inflationary expectations, an exchange rate change would have a larger impact on flexible-priced goods to compensate for the slow adjustment of more fixed-priced goods. The relative flexibility of agricultural commodity prices means these prices tend to respond more quickly to changes in macroeconomic policy (Saghaian, Reed and Marchant, 2002). Given the interrelationships between interest rates and exchange rates, understanding the impact of interest rates on agricultural prices means understanding the direct and indirect impacts through exchange rates.

Changes in monetary policy, specifically shifts in interest rates and money supply, affect agricultural commodity prices by affecting the demand for storable commodities. Frankel (2006) identifies several channels by which higher interest rates and a smaller supply of money reduces the demand for storable commodities and vice versa. Higher interest rates reduce the incentive to carry inventories by increasing the value of current cash holdings versus the present value of future income. Finally, higher interest rates entice speculators to shift financial assets toward treasuries and out of commodities, reducing the demand from this segment of market participants.

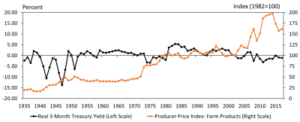

Historically, agricultural commodity prices tend to rise during periods of low real interest rates. For example, from 1940 to 1951, the producer price index for farm products rose 200% when real interest rates on 3-month treasuries were negative (Figure 1). A similar pattern emerged in the 1970s and more recently from 2005 to 2014. In fact, analyzing data from 1950 to 2005, Frankel (2006) found strong correlations between changes in real interest rates and agricultural commodity prices. The strongest relationships were in crop markets. Corn, wheat, soybean, and cotton prices fell 9.1%, 8.8%, 6.4%, and 6.1%, respectively, for every 1% increase in real interest rates. In contrast, cattle and hog prices fell 4.8% and 3.1%, respectively, for every 1% rise in real interest rates.

However, the responsiveness of agricultural commodity prices to shifts in monetary policy may be different today in a period of unconventional monetary policy. During the most recent recession, the Federal Reserve engaged in unconventional monetary policy by purchasing assets such as long-term treasuries and federal agency debt, which increased its balance sheet to $4.5 trillion, quadrupling the level prior to the recession. Unconventional monetary policies could affect the adjustments between interest rates and agricultural commodity prices in addition to providing a new mechanism, changes in the balance sheet, to affect agricultural commodity prices. Research has found that the responsiveness of agricultural commodity prices during periods of unconventional monetary policy was different. During unconventional periods of monetary policy, the full responsiveness of agricultural commodity prices was delayed and a 1% increase in the Federal Reserve balance sheet was associated with a 2% increase in agricultural commodity prices (Amatov and Dorfman, 2017). Although monetary tightening through rising interest rates and a smaller balance sheet will place downward pressure on commodity prices, the size and timing of the impacts may not follow past cycles.

Monetary Policy and Exchange Rates

In addition to their direct impacts on commodity prices, higher relative interest rates could also lead to lower commodity prices by altering exchange rates. Analysis of the direct impacts of interest rates on agricultural commodities has assumed that global interest rates adjust simultaneously. In practice, monetary policy and interest rate movements vary by country, and relative changes in interest rates affect global exchange rates. For example, higher interest rates in the United States relative to other nations could increase demand for and thus the value of the U.S. dollar as financial investors seek to buy U.S. financial instruments, such as treasuries, that offer higher returns.

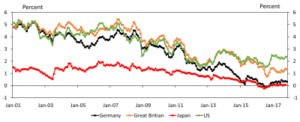

In recent years, differences in global interest rates have coincided with a shift in global investment flows. Since 2014, a gap between U.S. interest rates and interest rates in other developed nations emerged (Figure 2). As the yield on the 10-year treasury fluctuated around 2%, the yield on 10-year bond instruments from Germany, Japan, and the United Kingdom dropped below 1%. Negative interest rates in Europe pushed German interest rates to -0.12% by mid-2016.

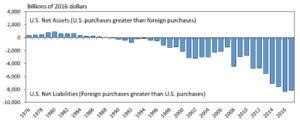

Coinciding with the higher level of U.S. interest rates, foreign purchases of U.S. assets have increased sharply. In the balance sheet of U.S. accounts, U.S. purchases of foreign assets are an asset and foreign purchases of U.S. assets are a liability. The difference between these assets and liabilities indicates the level of financial flows between U.S. and foreign markets. Net assets (more assets than liabilities) indicate more U.S. purchases of foreign assets than foreign purchases of U.S. assets. Net liabilities (more liabilities than assets) indicate more foreign purchases of U.S. assets than U.S. purchases of foreign assets. Since 2007, net

liabilities have increased substantially, with increases in both debt and equity purchases by foreign investors (Figure 3).

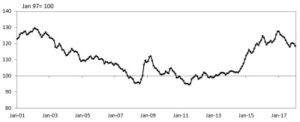

At the same time, the value of the dollar has increased sharply, rising approximately 20% since 2014 against a broad set of currencies (Figure 4). The rise in the value of the dollar was driven in part by investor demand for U.S. dollars to purchase U.S. assets. The opposite pattern emerged at the end of 2017 as the spread between U.S. and international interest rates narrowed. During this time, net foreign purchases of U.S. assets declined and the dollar weakened. Since agricultural commodity prices are priced in dollars, fluctuations in the U.S. dollar affect agricultural commodity prices: A stronger U.S. dollar boosts the price of agricultural commodity prices in global markets, thus reducing U.S. exports and vice versa.

Recently, economists have shown that the exchange rate impacts on agricultural commodity prices vary over time due to differences in supply and demand fundamentals. Specifically, tighter long-run inventories of agricultural commodities, ethanol policy mandates under the Renewable Fuels Standard, and stronger imports caused demand for commodities to be more inelastic, making commodity prices more responsive to exchange rate changes (Hatzenbuehler, Abbott, and Foster, 2016). In short, during periods of tight supplies and lean inventories, commodity prices would be more sensitive to exchange rate movements compared to periods of burgeoning supplies and swelling inventories.

The Future Path of Interest Rates and Exchange Rates

With stronger U.S. economic growth, the Federal Reserve is beginning to unwind its accommodative monetary policies by raising interest rates and shrinking its balance sheet. Higher interest rates have historically contributed to lower agricultural commodity prices. Yet future impacts will depend on global shifts in monetary policy and shifting dynamics in agricultural markets.

U.S. interest rates are starting to edge up. The Federal Reserve has increased the target for the overnight fed funds rate from 0.25 to 1.5%. The December quarterly projections on monetary policy suggest that rates could increase further. The central tendency from Federal Open Market Committee (FOMC) members at the Federal Reserve for the fed funds rate is projected to rise to a range of 2.5%–3.5%, with a median rate of 2.9%, by the end of 2020. In contrast, futures markets suggest that the fed funds rate could increase more slowly, rising to 2.0% by 2020.

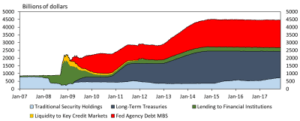

In addition, changes in the Federal Reserve’s balance sheet could also influence agricultural commodity prices. Past research has shown that, historically, money supply shifts impact commodity prices beyond interest rate impacts (Chambers and Just, 1982). Between 2008 and 2014, the Federal Reserve expanded its balance sheet from $800 billion to approximately $4.5 trillion to maintain the U.S. money supply as the velocity of money declined (Figure 5). In 2017, Federal Reserve assets consisted primarily of long-term treasuries and federal agency debt in the form of mortgage-backed securities (MBS).

In 2014, the Federal Reserve began its strategy of normalizing its balance sheet. The first step was to hold the levels of its balance sheet flat at $4.5 trillion. In July 2017, the Federal Reserve announced its strategy to shrink its balance sheet in the future by reducing the number of purchases of MBS and treasury bills to replace maturing securities. By October 2017, the Federal Reserve had implemented this policy. If followed, it will take several years to shrink the balance sheet to pre-recession levels. In isolation, higher interest rates and a smaller balance sheet would be expected to weigh on agricultural commodity prices going forward. However, the size of these impacts is uncertain in an era of unconventional monetary policy. In fact, the influence of interest rates will depend on global monetary policy movements and exchange rates.

The process of normalization in U.S. monetary policy has coincided with increases in U.S. exchange rates, which has contributed to lower agricultural commodity prices. However, further normalization—higher interest rates and a shrinking Federal Reserve balance sheet—may not necessarily lead to a stronger dollar if other central banks begin removing monetary stimulus in the face of stronger economic growth.

In the second half of 2017, economic growth unexpectedly strengthened in advanced countries. For example, quarterly U.S. economic growth forecasts were revised up in the second and third quarters of 2017, topping 3% after tepid growth in the first quarter of 2017. Economic growth forecasts point toward stronger unexpected growth in the Eurozone. In the January 2018 World Bank Global Economic Prospects Report, annual U.S. GDP growth was revised up 0.2 percentage points to 2.3% in 2017 compared to the June forecast, while the Eurozone forecast was revised up 0.7 percentage points to 2.4%. Similar revisions emerged for the 2018 forecasts. As a result, if stronger growth emerges in the Eurozone in 2018 and spreads to other regions, monetary policy could tighten globally, narrowing the gap between U.S. and international interest rates and weighing on the U.S. dollar, as currently indicated by futures markets.

Heading into 2018, a new pattern has begun to emerge. During the first few weeks of 2018, the spread between U.S. and international interest rates has narrowed. For example, the spread between the U.S. and German 10-year bonds had narrowed to 2.0 percentage points by the end of 2017, slightly less than the 2.4 percentage points in December 2016. In addition, after peaking in December 2016, the value of the dollar had declined roughly 7% against a broad set of U.S. currencies by the end of 2017. Heading into 2018, the impact of interest rates on agricultural commodity prices will depend on global monetary policy shifts and the spread between U.S. and international interest rates. More aggressive tightening in U.S. monetary policy compared to the rest of the world could lead to a wider interest rate spread, a stronger dollar, and weaker agricultural commodity prices. In contrast, less aggressive tightening in U.S. monetary policy could lead to a narrower interest rate spread, a weaker dollar, and support for higher agricultural commodity prices.

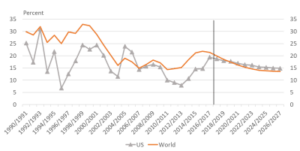

Although monetary policy should influence agricultural commodity prices, the presence of large crop inventories could mute the impact of macroeconomic factors (interest rates and exchange rates) on agricultural commodity prices. Burgeoning crops reduce the responsiveness of agricultural commodity prices to exchange rate movements decreasing the market elasticity of demand (Hatzenbuehler, Abbott, and Foster, 2016). After bottoming in 2014, crop inventories have increased substantially. For example, U.S. corn supply-to-use ratios have more than doubled, from 7.9 for the 2012/13 crop year to 19.9 for the 2017/18 crop year. During the same time, soybean supply-to-use ratios have risen from 7.9 to 20.5 and wheat supply-to-use ratios have risen from 51.7 to 82.3. USDA baseline projections suggest that inventories could remain elevated over the next decade, which would limit the impacts of exchange rates on agricultural commodity prices over the next decade compared to 2009 and 2014.

Shifting supply and demand dynamics could determine how crop inventories evolve over time. USDA projections indicate crop production will stabilize at current levels and that modest growth in global demand will trim inventories. For example, USDA projects planted acres for corn and corn production in the United States to decline over the next decade, with modest 1% annual growth in domestic use and export activity. Stronger than expected economic growth in advanced countries could spur agricultural commodity demand if stronger economic growth spreads globally to emerging countries, spurring agricultural trade.

Conclusion

Similar to past agricultural cycles, shifts in monetary policy are a risk to agricultural commodity prices. Rising U.S. interest rates and a smaller Federal Reserve balance sheet could weigh on agricultural commodity prices. Still, the magnitude of these impacts from monetary policy is uncertain and depends on global shifts in monetary policy, inflation, and its impacts on exchange rates. The impacts of monetary policy will depend on real interest rates, which are an interaction of inflation and nominal interest rates. As a result, if the Federal Reserve is ahead of the inflationary curve and increases nominal interest rates more swiftly than inflationary pressure increases, real interest rates would rise and depress agricultural commodity prices. Alternatively, if monetary policy falls behind the inflationary curve and short-term interest rates rise more slowly than inflation, real interest rates would fall and potentially underpin higher agricultural commodity prices.

In addition, the impact on agricultural commodity prices will also depend on the relationship between U.S. and international interest rates. A wider gap between U.S. and international interest rates could lead to a stronger dollar and lower agricultural commodity prices. In contrast, a narrower gap could lead to a weaker dollar and stronger agricultural commodity prices.

At the same time, the economic forces shaping the relative position of U.S. and international interest rates could also affect demand for agricultural products and thus commodity prices. Stronger economic growth, especially in developing nations, could spur demand for agricultural commodities and trim inventories of agricultural products, which would trigger some countervailing impacts on agricultural commodity prices. Rising interest rates would place downward pressure on agricultural commodity prices, and smaller inventories would increase the responsiveness of agricultural commodity prices to monetary policy factors. On the other hand, stronger economic growth internationally could increase demand for agricultural products and lead to a weaker dollar, which would support higher agricultural commodity prices.

U.S. monetary policy is in transition. Over the past century, shifts in U.S. monetary policy, economic growth, and exchange rates relative to other global shifts have shaped agricultural commodity prices. By itself, higher U.S. interest rates and shrinking balance sheets at the Federal Reserve will place downward pressure on agricultural commodity prices. Yet the size of these impacts could vary dramatically based on the relative shifts in international interest rates and agricultural market conditions. Understanding the relative relationships between U.S. and international markets is crucial to understanding the boom and bust cycles of U.S. agriculture.

To view the full article CLICK HERE