AgriPulse

By: Delaney Howell

As trade tensions continue to rise, the thought of having to deal with another tough year of tight or absent financial margins can be daunting. According to the USDA’s latest forecast, net farm income for 2018 is expected to fall to $59.5 billion, a 12-year low.

Couple the income forecast with rising interest rates – the Federal Reserve raised them twice this year and two more hikes are expected – and one can see why anxiety levels are growing for farmers who may not be able to repay operating or longer-term loans this fall.

Enter so-called “alternative” lenders, who are trying to fill the gaps where traditional agricultural lenders might not be able to help high-risk borrowers.

Some of the nation’s leading ag lenders are “particularly conservative with traditional activities and so that helps create opportunity for folks who can do slightly less traditional or slightly LTV (Loan to Value) lending,” notes University of Illinois Professor Bruce Sherrick. Some of those firms partner with more traditional lenders like community banks, Farmer Mac, and others.

One farm couple that witnessed the advantages of alternative lending is Barex Dairy Farm, operated by the Ottens from Centerfield, Utah. Russell and his wife, Taunya, took over the dairy in 1998, milking 200 cows, but after talking to a consulting company, realized they needed to expand or move on to other careers.

Russell Otten recalls that the couple almost “went into shock . . . 4,200 cows had never crossed our mind. So, we didn’t do anything for months.” After finally deciding to expand their herd, they also needed an increased credit line, but their hometown bank had a loan limit capacity of only $1.1 million.

In their search for additional financing, traditional lenders and even their FSA office declined to participate.

When the Ottens thought they were out of options, they finally found their light at the end of the tunnel after Clear Creek Land & Mortgage partnered with Conterra to find flexible credit for the Ottens.

“These rural lenders are the life-blood of rural America, and Conterra is very focused on providing products and services that enhance how credit is delivered,” especially for land investments, says Conterra CEO and founder Paul Erickson.

Another company that is focused only on operating loans is Ag Resource Management.

“Our focus on budgeting and risk management with customers leads to a stronger, more disciplined approach that benefits the producer in the long run” states Jay Landell, manager for ARM’s Central Region. “We focus on the potential of the crop we are financing this year and the expenses needed to get to harvest.”

However, lenders say that producers should clearly understand their options. Farmers should have their financials in top shape before discussing alternative lending options, and keep in mind that these options are usually short-term, points out Mark Scanlan, senior vice president of agriculture and rural policy for Independent Community Bankers of America.

Scanlan explains: “If the borrower is in a solid financial position but is requesting a loan that exceeds a bank’s lending limit, the bank can do the loan through Farmer Mac to avoid the lending limit or possibly do a participation with another lender. If the borrower’s financials show an inability to cash-flow, then an alternative funding source may be useful, particularly if they can continue working with the bank and help producers rebalance the balance sheet to return to conventional financing after a couple years.”

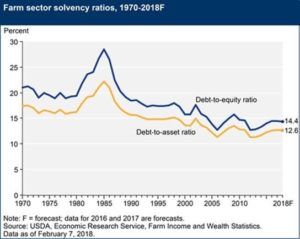

Overall, credit conditions may not be as bad as the 1980s, but lenders are still keeping a close eye on farm asset valuations, lower farm income and rising debt levels.

For 2018, farm debt is forecast at a record $389 billion, up nearly $4 billion from 2017’s record-high. Farm real estate debt in 2018 is projected at a record $239 billion, up $2.9 billion from last year. Non-real estate debt is also projected to reach a record $150 billion, but it remains in line with prior-year levels.

To View Full Article: Click Here