Ag lenders fear reduced government aid for farmers in 2021

American Banker

By: Jon Prior

Lenders are meeting with farmers this month — often over Zoom — about refinancing their debts ahead of a spring planting season that will be critical to turnaround efforts in U.S. agriculture.

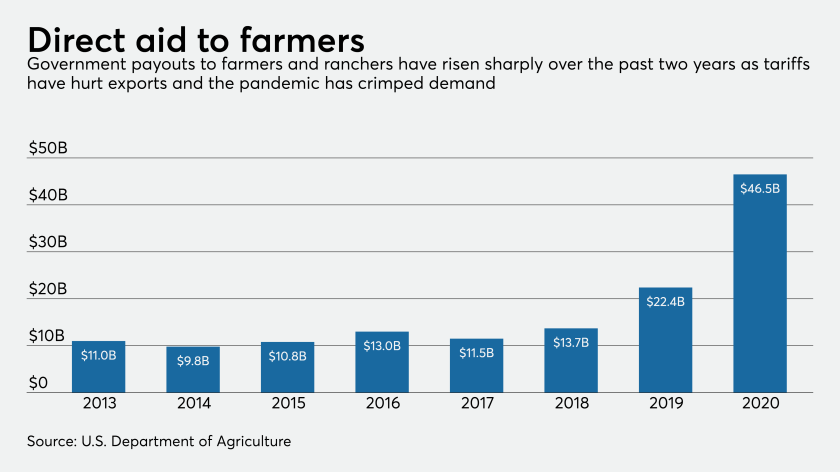

But a 2021 comeback will be especially challenging, most ag lenders say, because their customers will get far less help from Uncle Sam than they have in recent years. Farmers are forecast to receive $46.5 billion in direct government payments this year, or about 38% of net farm income, according to estimates from the U.S. Department of Agriculture.

“I don’t know if we’ll have the same government support we’ve had before,” said Shawn Smeins, the new head of Rabobank’s U.S. ag lending business. The $900 billion-asset Dutch bank has one of the largest farm financing operations in the United States.

The coronavirus relief package passed in March helped provide $16 billion to farmers to offset a drop-off in demand for crops and livestock. And $8.1 billion in Paycheck Protection Program loans had gone to the agriculture, forestry, hunting and fishing industries as of Aug. 8, according to the Treasury Department. This followed $28 billion set aside by the USDA over the previous two years to help farmers during the U.S. trade spat with China.

The hope is that a rebound in crop prices and easing tensions with China under President-elect Joe Biden will make up for the anticipated reductions in federal aid. Farm shipments to China have already started to recover after a tentative agreement was reached earlier this year to free up more trade.

Agriculture-related exports to China totaled more than $3.1 billion in September, up 45% from the previous month and the highest monthly total in nearly three years, according to the U.S. Census Bureau. Renewed demand helped push prices for soybeans to a four-year high this fall.

Farm income is projected to reach a level last seen in 2013, Smeins said, citing USDA data, and could increase as much as 43%. Without bigger government checks, Smeins said the question for ag lenders is whether “commodity prices increase enough to widen the gap between income and cost.”

“We are expecting 2021 to have significantly lower payments for U.S. farmers and ranchers than this year,” said Will Sawyer, lead economist for the $148 billion-asset CoBank. “But the increase in commodity prices will be a tremendous boost to the profitability of U.S. row crop producers.”

There is still plenty of trouble for ag lenders to work through as the coronavirus pandemic threatens rural communities nationwide.

There were 149 filings under Chapter 12 — the Bankruptcy Code section used by farmers and fisheries — in the third quarter, up from 115 in the previous three months, according to data from the Administrative Office of U.S. Courts.

Meanwhile, roughly 9 in 10 ag lenders surveyed by the American Bankers Association and Farmer Mac between Aug. 3 and Sept. 6 said their borrowers’ reliance on government checks increased in 2020.

Nearly 4% of the nation’s 1,200 ag banks were unprofitable as of September, according to Federal Deposit Insurance Corp. data. (The FDIC defines ag banks as those with more than 25% of their total loans going directly to support farming operations or to real estate credits secured by farmland.)

One in five farmers have been granted loan modifications because of the pandemic and the economic shutdown, according to the ABA and Farmer Mac survey.

And lenders are ready for more credit challenges, even as they try to help farmers prepare for spring planting. Nearly 60% said they expect higher loan delinquency rates going into 2021, according to the survey.

“Credit quality and the deterioration of agricultural loans remains the No. 1 concern facing lenders in 2020,” the survey said. “This sentiment was shared by respondents from institutions of all sizes and across all regions.”

There are some hints that the incoming Biden administration could ramp up government support if more turbulence for the agriculture industry emerges in 2021.

Biden is expected to select Tom Vilsack for another stint as secretary of agriculture, according to reports. Vilsack served in the position under President Obama from 2009 to 2017. Advocates have said Vilsack did not do enough to facilitate more loans for farmers of color and that he favored large corporate operations over lower-income families.

But Vilsack’s past speeches and testimony before Congress as head of the Agriculture Department, especially during a 2012 drought that put many farmers across the Midwest and their lenders on the brink, indicate an openness to more support if needed.

“They need a safety net,” Vilsack said at a conference in 2013.

Smeins said he was most looking forward to getting his ag team back out to the farms once coronavirus vaccines are widely distributed. But he is worried about the potential for a spike in cases before then.

“There are so many unknowns with it, if we get a spike with so many families spending Christmas together,” Smeins said.

Bob Hartwig, legal counsel and agriculture liaison for the Iowa Bankers Association, said early reports he’s received from ag lenders reaching out to farmers so far is that renewals of loans to help fund planting season next spring are going more smoothly. While the industry is optimistic of a rebound in farm country, no one is willing to assume one just yet.

“I can only say that we hope so,” Hartwig said. “We hope that it reverses.”

To View Full Article: Click Here