Resetting Expectations: The Great Loan Shortening

With the 2025 harvest in the bin, farmers shift their focus to the books. Along with tax planning and building next year’s crop budgets, farmers often spend a significant amount of time with their lenders in the winter months as together they map current and future credit demands. Indeed, farm loan demand has jumped during the past couple of years, boosted by tight farm profitability for many operations. With farm profitability expected to remain compressed, many farmers are looking to free up cash flow in any way possible, including managing their borrowing costs.

In general, there are two levers a producer can pull when selecting a loan: loan amortization length and rate reset period. A longer amortization on a loan helps spread out payments and reduce annual cash flows. This phenomenon is not unique to agriculture—the most popular home mortgage product tends to have a longer amortization period, especially among borrowers with lower incomes or smaller balance sheets. Data from the Federal Reserve Bank of Kansas City show that farm mortgage amortization lengths have steadily increased over the past two decades.

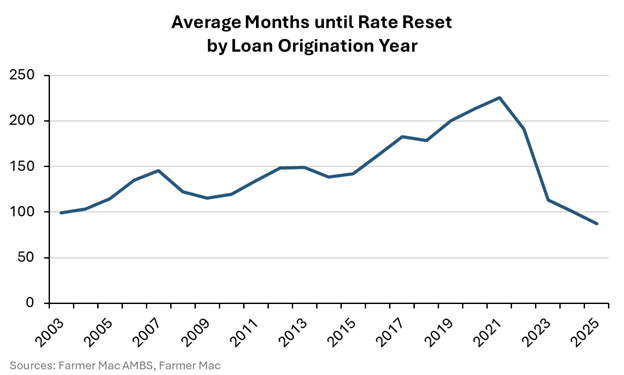

A relatively new development in farm mortgage loan selection has been a shortening of loan rate reset length. Data from the Federal Reserve Bank of Kansas City shows that, from 2003 through 2022, the average length of time between loan origination and the first rate reset increased relatively consistently from approximately 8 years to nearly 20 years. More recently, the trend has reversed. The average time to the first rate reset peaked in 2022 and has continued to decrease over the past three years. Through Q3 2025, the average has fallen to just over 7 years, which would be the lowest annual average in at least two decades.

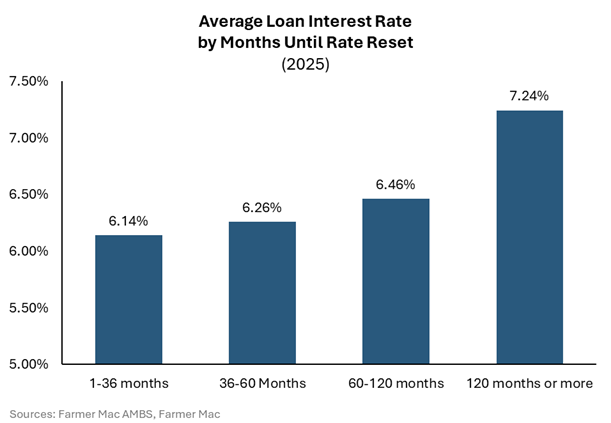

Occam’s razor implies that the simplest answer is often the correct one, and this could apply to the case of rate reset selection. Producers have likely been selecting loans with shorter rate reset periods simply because it reduces the overall interest rate on their loans. While a longer loan amortization period can reduce annual payments for borrowers, a longer rate reset period often leads to higher interest rates and higher payments. Of course, this can vary based on the yield curve and other factors. According to Farmer Mac Agricultural Mortgage Backed Securities (AMBS) data, the average interest rate in 2025 on a farmland loan was approximately 100 basis points (or 1.00%) lower for loans with a rate reset of 5 years or less than for loans with a rate reset of 10 years or more. As such, many borrowers have begun selecting loans with shorter interest rate reset periods by a large margin.

Does It Matter? Potentially

If loans with shorter rate reset periods help producers reduce their borrowing costs, where is the problem? In many scenarios, there isn’t one. It is possible that borrowers could see a similar, or even lower, interest rate when the reset occurs down the line. However, there’s a non-zero probability that market interest rates will increase between the origination date and the rate reset date.

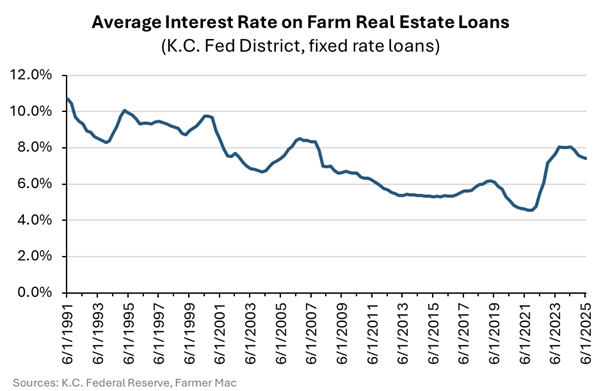

Interest rates today, while significantly higher than the recent lows of 2021 and 2022, are relatively average compared to the last 35 years. In fact, the most recent data from the Federal Reserve Bank of Kansas City shows that currently reported rates are almost identical to the average since 1991. Most of the periods of higher interest rates were over 20 years ago. However, there is no guarantee that rates return to more recent experience and could instead rise to even higher levels in the future. As a result, borrowers increase their exposure to interest rate risk when selecting loan products with shorter rate reset periods.

Conclusion

The outlook for interest rates is rarely clear, and the current conditions provide no exception. While the market expects short-term interest rates to decline over the next 12 months, the pace and magnitude of potential cuts lack clarity. Moreover, long-term interest rates face numerous ongoing factors, simultaneously pulling them both higher and lower. Farm borrowers may continue to opt for the lowest-rate loan product available, with the goal of locking in a lower rate later. This strategy might prove to be successful, but lenders should work closely with borrowers to educate them on the risks associated with such a strategy.