Farmer Mac’s Q1 Was On Track – A Crazy Cheap Stock And An Awesome Income Generator

Seeking Alpha

By: Gary J. Gordon

Summary

- Super cheap at a 6.4 P/E and a 5.6% dividend yield. Way below the S&P 500 average.

- Q1 Cash EPS was $2.19, up 8% from last year. I explain cash earnings.

- Farmer Mac has been put in the wrong investment buckets.

- Despite the turmoil, Q1 chargeoffs were $0 and the outlook looks good.

Farmer Mac (NYSE:AGM) reported its Q1 ’20 earnings Monday night. Mr. Market was not happy – the stock was down 6% the following day. But the earnings report, with a few minor squiggles, was right on target. Farmer Mac looks set to generate cash EPS of about $9 this year and maintain its $3.20 dividend. At its recent price of $57.50, that leaves it with a 6.4 P/E ratio and a 5.6% dividend yield. Let’s compare that to the S&P 500, shall we?

The relative P/E ratio. Since S&P 500 earnings will be godawful this year, I’ll use last year’s $163 EPS estimate provided by Yardeni Research. The S&P 500’s P/E sits at 17.6. And let’s be real, the next time S&P 500 EPS exceeds that number will be 2022 at the very earliest. So Farmer Mac is trading at 36% of the market multiple. That suggests a company ready to take a serious earnings tumble. The very opposite is almost certainly true; I’ll bet you right now that Farmer Mac’s EPS growth over the next two years will approach 10% annually.

The relative dividend yield. The S&P 500 dividend yield currently sits at 2.1%, so Farmer Mac is generating 2½ times the cash yield. I predict Farmer Mac will pay $3.60 next year and $4.00 in 2022. Again, not going very far out on a limb, I assert that Farmer Mac’s dividend growth will kick the S&P 500’s butt. Do you need income over the longer term? If so, look seriously at this stock.

My price target two years out – $150. That’s a 160% upside! Sounds like I’m pumping a cash-hemorrhaging online retailer. But that’s only a 13½ P/E on ’22 EPS. And still a relatively high 2.7% dividend yield.

The first quarter

During troubled economic times, analyzing the earnings of banks and other lenders like Farmer Mac becomes problematic because of the required accounting for loan chargeoffs. The bad loan expense item is not actually cash chargeoffs. Rather, it is a “loss provision,” which includes both a recognition of current chargeoffs and some forecast of future expected chargeoffs. The forecast is of course a squishy number. Companies can use a range of forecasts from very optimistic to very pessimistic. And honestly, folks, based on my 25 years of experience as a consumer lender stock analyst, companies are usually way off on their forecasts.

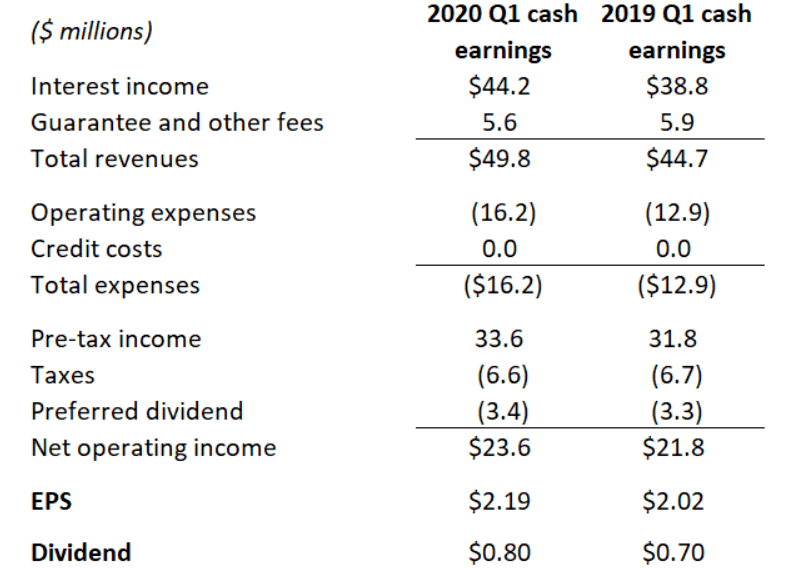

Because of that, from here on out I’m using a “cash earnings” approach. That means I replace the reported loss provision with actual chargeoffs. It is then my responsibility to forecast where chargeoffs are going. But you at least get a snapshot of the company’s current earnings power. So here is Farmer Mac’s cash earnings for Q1 ’20 compared to a year ago:

Farmer Mac reported a “core” EPS estimate of $1.87. But I replaced the $3.3 million pre-tax loss provision with actual chargeoffs of – zero. Yes, zero. More on that shortly. So my cash EPS estimate is $2.19 per share, up 8% from last year. But Farmer Mac’s true earnings power is still understated. The table shows a large jump in Q1 ’20 operating expenses. But some of the increase was non-recurring – an exiting executive’s severance and an extra bonus accrual because ’19 earnings was stronger than expected. I think a better estimate of earnings power is about $2.30 per share. That running rate is already better than my $9 EPS estimate for this year.

What Mr. Market isn’t seeing. The bucket problem.

Why is Farmer Mac’s stock so cheap? I think in large part because it is being dumped into two buckets it doesn’t belong in. One I’ll call the “non-online bucket.” I think investors now expect only online businesses to grow, while non-onlines struggle with steadily losing market share. But Farmer Mac is a government-sponsored enterprise (GSE), giving it competitive advantages over other lenders that allows it to relatively safely grow market share.

The other bucket Farmer Mac doesn’t belong in is what I’ll call the “bank bucket.” For the foreseeable future, banks are going to struggle mightily with chargeoffs and the flat yield curve. For example, Citibank’s (NYSE:C) EPS, which was $8 last year, is expected by Wall Street analysts to drop to $3 this year and $6 next year (CNBC). But Farmer Mac barely feels these problems. Again, I expect it to deliver solid EPS growth this year and going forward. The biggest difference from banks is…

Farmer Mac’s terrific credit story

I start by repeating – Farmer Mac had $0 in chargeoffs during Q1. This is not an anomaly. Farmer Mac has averaged only 2 bp in annual chargeoffs during the last two decades. But this time is different, no? What about the COVID-19 risk? Farmer Mac reviewed the bad news on its Tuesday conference call:

- Farmers’ out-of-the-home food channel is seriously wounded. Restaurants, offices, hotels, schools are shut.

- Many slaughterhouses are shut, throwing meat production out of whack.

- Less driving means ethanol demand is way down. During normal times up to 40% of the U.S. corn crop ends up in our gas tanks.

- The stronger dollar has hurt food exports.

Farmers must be in big trouble, right? Then why did Farmer Mac only set aside a $3 million in loss provision for Q1? Because of this good news:

- Just because we are not eating at schools and hotels or inside restaurants doesn’t mean we aren’t eating. So farmers are learning to sell more to grocery stores.

- The government loves farmers. It already created a $16 billion subsidy for farmers, including those ethanol-challenged corn growers. And another $14 billion was set aside that might be released later this year.

- Farmers are eligible for the paycheck-protection program.

- The large drop in energy prices cut the price of fuel and fertilizer.

- Finally, Farmer Mac knows what it is doing. First, its loans to farmers and ranchers represents less than 40% of its total earning assets. And the other earning assets have never generated a single dollar of chargeoffs. And only 1.0% of the farmer/rancher loans are currently delinquent. Farmer Mac underwrites to both land value and cash flow standards and it is diversified across the country to many different farm products.

Yes, Farmer Mac will experience some chargeoffs over the next few years. But I am confident that the chargeoffs won’t materially knock the company off my EPS expectations.

Remember that $150 price target. And have a good day.

Disclosure: I am/we are long AGM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

To View Full Article: Click Here