4 Tips To Secure An Operating Loan

TopProducer

By: Anna-Lisa Laca

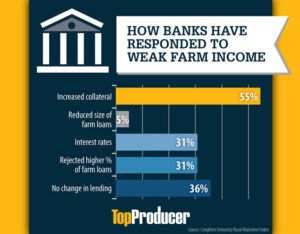

It’s no secret that farmers across the country continue to struggle. In fact, 31% of bankers who participate in Creighton University’s August Rural Mainstreet Index reported rejecting a higher percentage of farm loans than they did in July.

Jim Moriarty a dairy specialist with Compeer Financial, says operating loan and credit line renewals are likely to be more difficult than they usually are.

If you’re planning on seeking financing in the coming year, there are four things top operators can do to make securing that loan easier and faster.

1. Prepare An Annual Report

Write an annual report of your operation. A good overview not only describes your operation’s performance during the past year but also highlights the opportunities and challenges you face, Peter Martin of KCOE ISOM says.

“This document helps avoid misunderstandings among the chain of people who will review your loan request,” he says. “I had a client who was quite surprised when his loan request was declined after a couple of weeks. Turns out he had communicated his operation’s information in a conversation, not in writing. By the time his loan request had been passed to the credit analyst and approvers at the bank, his request was skewed and error-ridden. A written report removes that trap.”

He advises producers include important information like the past year’s crops, yields, acreage or equipment purchases or sales, employee turnover, successes and failures.

“It’s even a good idea to provide an update on your family,” he says.

2. Get Your Financial House In Order

You must provide your banker with quality and timely financial info. The financial statement is a key form of communication between the lender and the borrower. According to Martin, producers should be sure their balance sheet reflects their assets and liabilities at true market value; don’t under- or overestimate.

“Double-check your income statement to ensure it gives a true accrual-based picture of what happened in the preceding year,” he advises. “I particularly like to see a cash flow statement. When paired with an income statement, it shows exactly where your money came from and where it went.”

Martin advises producers to give themselves plenty of time to gather the appropriate financial information.

3. Present A Plan

“It’s your job to present a plan to your banker,” says Curt Covington executive vice president of agriculture finance for Farmer Mac. “It’s not your banker’s job to come up with a plan.” Provide income projections and assumptions. Martin advises stress testing those projections as well.

“Your outlook should include input costs, projected crop prices and expected profit and loss. Beyond that, offer best-case, most likely and worst-case scenarios of expected revenues and expenses,” he says. “All three “what if” projections should demonstrate your ability to repay the loan. If you have already forward-contracted 50% of your crop, show your lender you’ve taken steps to mitigate risk.”

4. Plan Your Ask

“Determine how much you need for your operating loan and then be able to justify it,” Covington says. Be prepared to ask your banker for the financing you need. Bankers don’t want to hear ‘I’ll take the same amount I took last year,’ he says. Also, be prepared to discuss any equipment financing needs.

To View Full Article: Click Here